Fintech Unicorn Airwallex seems to continue to go from strength to strength; the startup managed to complete its largest funding round (US$160M) mid-pandemic and has recently introduced WeChat Pay as part of its payment options, opening up the Asian marketplace to Australian business.

The Melbourne-founded global leader was also recently recognised – in November last year – as a topranked fintech in the KPMG Fintech100 report for 2019, a global list of the world’s best fintech innovators.

Their launch of WeChat Pay has been introduced as a stimulus to the Australian economy post-coronavirus. The expansion of the additional payment option will see Airwallex’s customer base instantly open up to the over 800 million Chinese consumers using WeChat Pay.

Dave Stein, Airwallex’s Head of Corporate Development in Australia said that he expects e-commerce trends will continue post-pandemic.

“We have seen e-commerce thrive during these unprecedented times. We believe this transition is here to stay even after the global lockdown ends, life normalises and shops reopen.

“As more merchants transition online, they require a wide range of payment acceptance options to remain relevant to different payment preferences around the world. We are enabling merchants to adapt in today’s climate and also helping them open the doors to one of the largest and most active consumer markets in this world.”

We spoke more to Dave Stein, and as well as other Airwallex leaders, to gain a little more insight into what it takes to achieve the growth that AirWallex has so far.

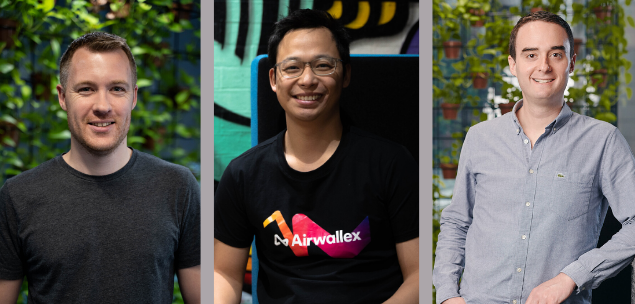

- Dave Stein, Head of Corporate Development, talks to us about customer acquisition

- Neil Luo, Head of Growth, talks to us about the barriers they have faced in growth

- Rylan Dawes, VP of FX Product, cautions us on operating in the financial (international) market

How are you building excellent customer relationships at Airwallex – new and existing?

Dave Stein, Head of Corporate Development at Airwallex

The key to building and sustaining customer relationships starts from a company culture that is customer-focused. At Airwallex, we put our customers at the forefront of everything we do. Our teams across all departments understand the significant role they play in impacting and contributing to the overarching customer experience.

We have been successful in fostering excellent customer relationships through these four ways:

From the start, we get to know our customers well so that we can effectively meet and anticipate their needs. For example, we run individual workshops to understand and work through unique pain points, which is especially important for new customers with more complex needs.

We show that we are responsive by addressing inquiries and solving issues rapidly. It is important that we nurture relationships with customers that we do not hear from often as well. By proactively communicating about trends in their industry, we find new opportunities and ways in which we can help grow their business internationally.

We provide a personal touch to humanise the experience throughout the customer journey. Instead of reaching a call centre, our Australian customers are assured of direct access to my team for dedicated support in the same time zone.

We take customer feedback seriously. For example, we recently rolled out an integration with Xero, which was the number one request from our Australian customers. Responding and adapting our product to our customers’ changing needs will further drive customer loyalty and maintain our reputation as a trusted partner.

What do you feel are/have been the main barriers to business growth?

Neil Luo, Head of Growth, Airwallex

Growth – and more specifically, customer acquisition – is undoubtedly the number one priority for most small businesses. The reality is that for most Australian businesses to grow, they need to think beyond the Australian market. The Australian economy makes up less than 2% of the world economy – expanding your business into the US, UK and EU will allow you access to over 30% of the world economy, a 15x increase in addressable market size versus Australia.

For traditional businesses, the transition from offline to online is usually gradual. However, today’s COVID-19 situation has forced many to quickly create an ecommerce presence for survival.

Expanding and selling overseas has never been easier in today’s digital age. However, a major challenge that businesses face with international expansion through ecommerce lies in financial services. We’ve heard from many businesses that setting up a bank account in the UK, US or EU is a massive hassle. It can be time-intensive, confusing, and dealing with the time zone challenges can be difficult.

The opportunities that fintechs present mean that these barriers can be lifted. For example, our Global accounts feature allows businesses to create USD, EUR or GBP bank accounts instantly and online.

What is the top thing to be wary of when operating in the financial market?

Rylan Dawes, VP of FX Product, Airwallex

Small businesses operating in multiple markets and across borders need to be conscious of the foreign exchange (FX) market. The top thing to be wary of is the volatility in these FX markets.

Recently, we saw the Aussie dollar tumble significantly and dip to its 17-year time low. While the AUD has gathered some pace against the weakening USD, it is still expected to fluctuate during these uncertain times.

What does this mean for small businesses?

When there is fluctuation in the AUD, it increases foreign exchange risk, which is the risk imposed on a business’ financial performance by changes in currency exchange rates. Without careful planning, sharp moves in exchange rates can damage profitability by eroding profit margins – adding to existing cash flow concerns that small businesses are already facing today.

A simple way that small businesses can manage foreign currency risk involves setting up foreign exchange account, then depositing funds in desired currencies into the account – and leaving them there. By holding the funds until you need to convert it or pay it out, you are able to make the most of FX rates when they’re strong. It also ensures that the correct funds will always be available and takes into account the potential fluctuations of the currency.

Lastly, shop around for the right foreign exchange account to avoid getting burnt by hidden transaction fees.