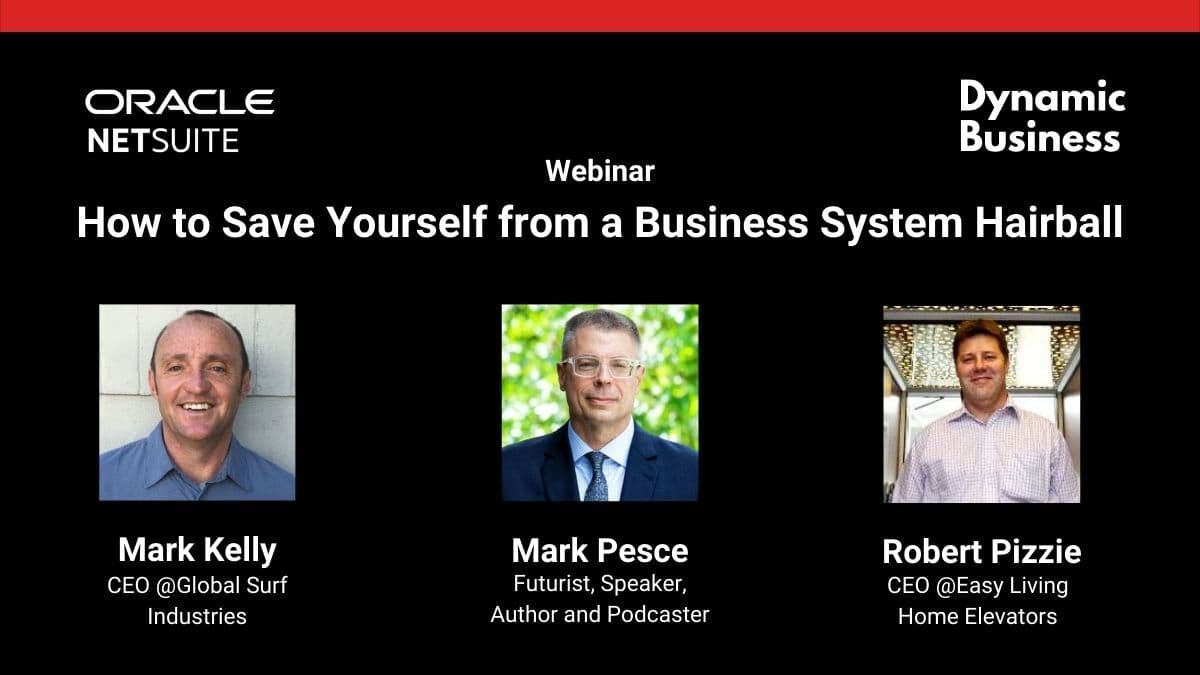

A fireside chat with Mark Kelly, CEO of Global Surf Industries and Robert Pizzie, CEO of Easy Living Home Elevators; hosted by Mark Pesce

Mark Pesce:

“Good afternoon everyone. Welcome. My name is Mark Pesce. I’m a futurist, author, educator, and I’m the host of the next billion seconds podcast.

“Welcome to how to save yourself from a business system hairball brought to you by Dynamic Business in partnership with Oracle, NetSuite.

“I’ll be your host over the next sort of 40 or so minutes as we explore this topic in two fireside chats. First, we’ll have a yarn with Mark Kelly, CEO of global surf industries.

“After 20 years in the business, Mark was asking whether he’d made his life better for himself or any of his employees. And that question led to a surprising answer. We’ll hear more about that soon.

“And after Mark Kelly, we’ll be joined by Robert Pizzie, CEO of easy living home elevators. We’ll hear about Robert’s journey from a fledgling business to an industry leader in Australia, and ask him what he’s learned about what it takes to scale a business in a very tight labour market.

“Now, a little bit of housekeeping upfront. All of this is being recorded today. So don’t worry that you’re going to miss something because we’ll have it up on the dynamic business website. You’ll be able to go back and listen to it anytime you want. You will be able to ask questions of both Mark and Robert.

“There’s a portion of the program at the end where Heidi will come on and we’ll read out your questions. So post your questions in either the chatbox or in the Q&A box. Heidi is keeping an eye on those and she’ll be joining us further along when we’ll share those questions. All right. That’s all the housekeeping.

“We know that if you want to scale a business, you need a good product. You need great staff and you need really solid business systems.

“Most businesses have no system at all, when they start up, they use whatever they have at hand. And almost everyone starts out by using a few spreadsheets. I’ve been guilty of that I bet most of you have. And most businesses as they grow, they reach the limits of the tools that they’re using. And every time that happens, there’s a scramble and they change their tool.

“Of course, it never happens for every tool at the same time. Different tools reach their peaks at different points. And so what happens is the tools start to diverge over time, you grab one from over here because it’s what someone used on their last job, you grab one from over here because an employee recommended it. And this one, no one knows quite where this one came from, but it gets the job done.

“It’s all organic, no one really gives it a lot of thought. But of course, because all these tools just sort of arose organically, there’s no way to really manage them all together or to use them as a unit.

“In fact, a lot of work has to go into making them work together. And so there you are, you have your own corporate Hairball, a Frankenstack of tools that are all from different places.

“They’re all suited to the jobs they’re doing, but none of them are really compatible with any of the others.

“That is a hard place to be stuck. Because changing tools takes time, it means costs and it also means that there’s a chance things might blow up, that data might get lost, that customers might be impacted.

“So businesses tend to kick the can down the road when it comes to changing tools until they can’t. That’s pretty much what happened to Mark Kelly. So let’s take this opportunity to bring the mark into the webinar. Mark is the founder and the CEO of global surf industries. Welcome Mark, tell us how you’re doing today.”

Mark Kelly:

“Pretty good Mark, I’m enjoying life. Sydney was 25 degrees in the water today, so that’s pretty good.”

Mark Pesce:

“It is pretty good. Okay, so tell us about Global Surf Industries. When did you get started? And how did you get this vision that the best day is a day that you’ve been surfing?”

Mark Kelly:

“We started the company in 2002. I’d been working in the surf industry for four or five years before that. I’d worked for companies like Bausch and Lomb and Adidas. All big multinational companies. So I sort of had a big business mindset. But the surf industry is focused on the hardware side. Really, for a lot of us it is still a cottage industry.

“So, we’re just beginning to bring big business skills to our cottage industry, and part of that was having really good business processes.”

Mark Pesce:

“So the business grew from basically a small startup in 2002. How were you doing over the arc of the business before the pandemic hit?”

Mark Kelly:

“So the business has been going 20 years this year, and in late 2019, I’d sort of come to the conclusion that in 2002, we were really a disruptive company in the industry. And we were taking it from cottage industry to a normal sort of product development, now it’s a supply industry.

“At that time [2019], I thought to myself that the business had sort of run its race. We had a lot of competitors coming in, nipping at our heels, and we’d built an eight-figure business, selling around the world. But, we were selling close to 50,000 boards a year, but not really making that much cash.

“It wasn’t really making a big bottom line, even though we were turning over a lot of money. I think part of that was inheriting the business that you sort of had yesterday, today all the time.

“So at the end of 2019, I sort of was at the point where I decided that I was going to close the business and just liquidate everything and go do a university degree in anthropology. And then COVID started.

“As I talked to the staff and told them what I was going to do, they said a lot of them decided to leave and have more job security. Six of the staff I asked to stay on and helped me wind the company down but as COVID got going. But as COVID went on and we were operating with the remaining six staff we were turning over the same net as we were when we had 22 staff.

“So profitability went from marginal to extreme. We were running at a net profit of 26% with six people. Some of that comes down to me jumping back on the tools, which I still am. And I’m really enjoying it actually, after 20 years of being in the back of the operations rather than just general management. It’s actually really good to be in the business.

“But in a company with six people that turns over, upwards of around about 20 million Aussie dollars, you need to be. And from that point, it just really sort of made sense.

“But for me, knowing how NetSuite worked, I could really start to look at all automation and make the program or the ERP system function beyond what we’re doing. That really saves me from employing more people.

“Not that that’s a bad thing, I’m not anti-employee. But I was at a point where I just really want to make the system work. And for me, I like to think of NetSuite as the human brain. Apparently, we’re only using about 8 per cent of our brain. So I want to avoid paying for 100 per cent of NetSuite, I want to try and get 100 per cent of the value-added.”

Mark Pesce:

“Alright, but we talked about the percentages, right, you have basically about 26 per cent of the employees that you had back in 2019.

“So you have a quarter of the staff turning to the same amount of money. How did you manage that transition? In other words, I mean, some of it was organic, but you had six people? Did everyone start doing four times as much work? Or was there a relationship to tools that changed through that?”

Mark Kelly:

“You just have to re-jig. This is a big thing for me now, if you don’t, someone can come and disrupt your business. But if you’re not thinking like that all the time, that someone’s going to disrupt the business, and you keep going as you are, and then someone will disrupt the business and your business will be gone.

“And so I think everyone in every business should look at their business every 18 months and say if someone was going to start this business again today, how would they do it?”

Mark Pesce:

“And if you were starting again. Wait a second, actually, you did start the business again, in 2020. That’s the thing, right? Because you basically made the decision, you were going to close the business, which put the business on a completely different footing?”

Mark Kelly:

“Yeah, and we did, we announced the customers, we’re gonna call it GSI 2.0. and here’s the process we’re going to do.

“We don’t do any data entry anymore. I outsourced that to either our web consumers or our customers. And we’ve got a platform where they can log in and do their orders, they can pay their bills online, all that now is reconciled itself through a Suite app that we’ve got.

“We’ve moved our website to Shopify, we’ve got Celigo running different APIs, meaning we’ve reconciled a lot of the business operations. So we’re just trying to save man-hours all the time. So then the employers that we’ve got are doing proactive tasks rather than just menial things, like just moving data. If you can move data around, you can automate.

Mark Pesce:

“So when did you have that? I mean, it sounds like there was a penny dropping here somewhere around your business.

“The number of employees and the tools, when did you really get the sense that, wait a minute, this is actually working better than it used to work?”

Mark Kelly:

“It was at the point where in Australia, all the staff except myself and the CFO had left. Then I was turning over, you know, 5 hundred-6 hundred thousand bucks in a month. And I didn’t have any employees.

“So, we’re making a net profit of 26-27%. I’m still paying myself what I used to pay myself but, our bottom line just went through the roof. And at that point, I’m thinking, this is actually just too good to stop. So I had a think about it, and then I said, “okay if we can run it like this, but then you’ve got to make sure that you’ve got the right people on the team.”

“So I spoke to the staff and said, “This is how I want to run it. Are you happy to stay on? Are you happy to run in this fashion?”, and everyone, everyone was up for it.

“So it has really allowed us to have a manageable, biggest, smallest company. I don’t want to be Amazon, I don’t want to be a massive company. I just really want to serve the customers that we’ve got and let the business be as big or as small as it wants to be.

“And we’re in a seasonal business. But, we operate globally. So we have summer and winter operating at the same time, it’s a yin yang thing. But for us, now every day is a good day of the month.

Mark Pesce:

So at that time, when you invited the six employees to stay on and run the company. Did you say, “Okay, we’re going to have to do things differently? And we’re going to need to train you in the new systems”. Was that part of that process? Or did they already know?

Mark Kelly:

“They already knew. So all we did was things like instead of having an Accounts person, who used to call when someone wasn’t paying on time, just gave that all back to the sales guys and said, “Okay, that person’s not going to exist, you guys can do your own debt collection now”.

“They get paid a base salary plus commission, and their commission comes when the customer pays. So why weren’t they in charge of it the whole time? They’ve got access to all the NetSuite data about payables.

“There are just some things in business that you inherit because you put those systems in place. But in 2002, the world was a completely different place than it is now. And we were still operating a lot of the business in the 2002 mindset.

“So, the company’s profitability scaled down over time, but it’s because we weren’t really disrupting ourselves, even though we were using the correct tools.

“We were using zoom years and years ago. We were probably one of the first customers in Australia of zoom. We’ve always used great tools, and we’ve always had a global business.

“But, I was just layering things on and creating jobs for people rather than using the platforms and really thinking in a disruptive way to how to run the business. So I think it’s a really good thing for everyone to think about.”

Mark Pesce:

“Which for your business, for global surf industries, which parts of NetSuite are most core to that ability to be able to disrupt yourself? What are the most important parts?”

Mark Kelly:

“This is a really interesting thing about NetSuite. A lot of people I’ve referred to NetSuite, they’ve let their CFO do the implementation.

“And if you want to shoot yourself in the head, do it that way. Because it’s not just a financial and accounting thing. It’s all parts of the business. So you need all the people around the room, a lot of it should be the CEO making the calls.

“Because at the end of the day, it’s not just accounting, its sales, its warehouse people, its operations, its customer service, they all use this one platform. And the best thing to do is have everyone understand what the dynamic tool is you’re using, so you can get the most out of it.

“I think that the biggest part of NetSuite is getting everyone to actually understand the power of what they’ve got.”

Mark Pesce:

“I like that warning to not let the accountants design the process flow for the rest of the organisation. I think that is very well observed.

“All right, we’re now sailing into roughly the post-pandemic era, right? The restrictions are now really being scaled back in Victoria and New South Wales just today. Are you planning on adding more employees? Or do you reckon this is the new normal for you?”

Mark Kelly:

“Well, I’m not sure I’m moving in the post-pandemic stage. So I’ve got a totally different mindset from you. Here in Brookvale, we’ve got businesses right beside us that are getting disrupted every day. For example, the guy who runs the business next door, one of his kids has COVID, so he’s locked down for several days.

“I think this stuff is gonna last. Last month, there were 12,000 school kids who got COVID. So we’re not moving into the post-pandemic stage, just yet.

“But for me, within the next year will probably bring one more staff member on to help run the global business. I’ve put a lot of pressure on myself. I don’t want to be out of action for a week because that would be good for me, but it probably wouldn’t be good for the business either.

“So I think for me, it’s just a little bit of risk management. And I’ll bring someone on the operations side of things to run the business globally. So that’ll be it.”

Mark Pesce:

“But you’ll top out at seven employees, and you’ll still have this really strong, really profitable business.

“All right. Thank you, Mark, we’re gonna have you back in just a few more minutes to answer some questions from the audience. Just a reminder that if you have questions, drop them in the chat or the Q&A box. And we’ll have Mark back after we talk to Robert.

“Now, growth can be one of the biggest stressors in a business. In a business when things are growing fast, everything’s working well, until it doesn’t. Business processes can degrade very gradually so that you don’t really even notice that things are getting incrementally harder.

“And that’s because people will keep on doing things the way they’ve always been done even when that is now no longer working when they actually do need to change because they’re breaking the business.

“One individual who has faced a few of those challenges is Robert Pizzie. Robert is the co-founder and CEO of Easy Living Elevators. Robert is going to join us to share what he’s learned about how to grow a business to a national scale.

“Hey, Robert, good afternoon.”

Robert Pizzie:

“G’day Mate.”

Mark Pesce:

“Alright, so tell us about easy living home elevators.”

Robert Pizzie:

“Well, we started in 1998, as a couple of wide-eyed young men who had some great ideas about what they wanted to do in the home elevator space. And then we quite astoundingly grew very quickly.

“I was in the big corporate space, working with big elevator companies, so I’m industry trained. I’m a technician by trade. And when I was in the sales office, people would ring up and say, Do you “big lift company” do lift in houses? And of course, I said no.

“So identifying a niche, being a little bit frustrated with big corporate, off we went and the rest, as they say, is history.”

Mark Pesce:

“How fast did things grow then? Did you take off like a rocket?”

Robert Pizzie:

“Yeah, well, talking just sales numbers, we sold three lifts in the year 2000. We sold 28 lifts in 2001, 48 in 2002. And then from there, we sell about 600 to 615 lifts a year.”

Mark Pesce:

“Okay so the first year was slow, and then you took off like a rocket ship?”

Robert Pizzie:

Yeah, yeah. Once we got some brand recognition out there we really took off.

Mark Pesce:

“So how many offices did you have? And did you start out with this many or did you open offices around the country as you went along?”

Robert Pizzie:

“Well, of course, we were just one office in Sydney. And then, through sheer luck, one of our main competitors fell on hard times, and we bought them out.

“So that was more than a reverse buyout, they were a much bigger company than us. They had offices in Brisbane, Sydney, and Melbourne. So overnight, we had an East Coast footprint that we needed to cover.

“So, we instantly needed systems and processes. And, you know, the old business systems we were using were adequate for the time, we used everything disjointed, there was no, as they say, single source of truth. And the systems didn’t talk to each other.”

Mark Pesce:

“And when you bought this new business, you got three more offices that also didn’t talk to each other.”

Robert Pizzie:

“Pretty much. Everything was very manual labour heavy, there wasn’t anything integration of systems. Everything was data entry, all that sort of stuff.”

Mark Pesce:

“Alright, so with all of these different pieces, did things start to break in the business? Were things getting lost or processes slowing down?”

Robert Pizzie:

“Well, it probably sounds like I’m not in tune with my business. But the first piece of evidence was that people started to break. They were protecting me from reality by saying everything was fine, but they were just working harder and harder, putting in longer and longer hours, and the results were not being achieved.

“So we lost a couple of good people. And I asked why? They said the “Job’s just getting too hard.” So that made us have a really deep look at how we operated and then we went through our first attempt at putting in an ERP system or selecting an AIP system.

“That got stopped because the CFO didn’t like any of them, and he was sort of more old system-centric, he was more comfortable in that space. Then he went, and we started the process again, and with a young lady who is now our CFO. She has worked in every part of the business, and was an honours graduate of accountancy, but wasn’t given the opportunity to fly.

“And she was very, not confident, and said, “No Rob, I can’t do the job, I can’t do the job.” So I gave her the job. And she is a Star! So just on the comment that Mark made, don’t let your CFO start your ERP system or design it, she actually has been a big part of it. But because she knows every part of the business and not just accountancy she’s built a cracking system.”

Mark Pesce:

“But she’s been able to bring that experience and all of the other parts of the business so that they will all be heard in the design. So we got it, we got to put a little asterisk next to her. She’s especially talented for that, not just a CFO.

“So you had people breaking, you had the change CFO, you managed to settle on a system, you made the decision to transition to NetSuite, what did it take to make that decision happen?”

Robert Pizzie:

“I guess looking at the entire ERP landscape, and seeing the NetSuite ability for all these other apps and third-party solutions to be bolted to the core software.

“And the other ones we looked at, didn’t have that they had “This is our system. If you want to change, you’ve got to talk to us. And then we’ll think about it for a few months.” And so the agility of the NetSuite platform with those third-party providers was a big part of the decision.”

Mark Pesce:

“When did you start the transition?”

Robert Pizzie:

“Around the middle of 2018 is when we started the project. And then what happened was our main supplier had a few financial difficulties. And that dragged us into it. So we were happy to pause the project while we figured out that little dilemma. Then we started back up again and we went 100 miles an hour. Now we have a great system in place.”

Mark Pesce:

“What were the benefits to the business? And were there obvious benefits immediately? What happened when you made the transition? How does the business change as a result?”

Robert Pizzie:

“Well, the immediate benefit was that my financial reports were out within the first week of the following month, rather than week three.

“My rearview mirror, under the old system, was a long-range one because I wasn’t getting the reports in anything close to a timely manner.

“So that was the first benefit. We were making better decisions because we were getting the information faster.

“Also my business dashboard has everything I need to know every morning in front of me. So they’re the benefits. Now we’re working on improving dashboards for all the different positions in the business. So that when staff switch on, they get the metrics that they need.”

Mark Pesce:

“And that will set the tone for what they have to prioritise that day for the business. Now, we listened to Mark talk about doing more with fewer employees.

“He’s got basically 25 per cent of the employees that he had, and he’s doing the same amount of trade. We are in a period of time now where it’s very hard to hire new people, right? And it looks like that’s going to be the case for a while. Are you seeing the same sorts of pressures on your business that Mark was with respect to employees?”

Robert Pizzie:

“Absolutely. We’re a trade based organisation. So tradespeople are in desperately short supply. You know, the overseas workers, they’ve all gone home, the Irish electricians, and they’ve gone back to Ireland, and they ain’t coming back anytime soon. So we’ve had to adapt to the other thing that was an issue was we set up our training centre in Brisbane.

“And of course, the Queensland board has been. So we’ve had to do a lot of this type of Zoom meeting training, which is work to a point. But that practical side is still a bit of a challenge for us. But now that it’s open, we’re fine.”

Mark Pesce:

“But do you see the tools also coming in to help you support doing more with the same number or even fewer staff? Are they offering that level of support to you?”

Robert Pizzie:

“Right now, we don’t need any more admin staff. We only need salespeople. So the business is ready to ramp up again. Because the market is quite buoyant. You know, you’ve got the Sunshine Coast in Queensland really going off. The Sydney market is really strong. Melbourne, that’s just grinding back to life. So we need salespeople.

Mark Pesce:

“So if anyone’s listening. All right, you’ve been on what sounds like it’s a four-year journey so far. So you’ve learned a lot if I handed you a time machine, and you could go back to 2018? And you could tell yourself one thing about the journey ahead, what would you tell yourself?”

Robert Pizzie:

“Get more people involved early, so that they understand the system better, rather than just thrusting it upon them. And yeah, put the time in earlier, rather than just staging it through the longer journey, which we have, just get on it and fix it.”

Mark Pesce:

“Alright, excellent. Thank you just stay right there Robert. We have learned a lot from Robert, and from Mark’s learnings at global surf industries. And if you’re growing your own business, you’ve probably found some points of similarity in both of these stories. So let’s bring Mark Kelly back in.

“Well, welcome back, Mark.”

Mark Kelly:

“That was great Robert!”

Mark Pesce:

“So we’ve heard a lot now. What both of you have done is consolidate your tools to make your businesses easier to run. My question to both of you is, where are you going to go from here? Let’s begin with you Mark, what’s your next step now?”

Mark Kelly:

“The next step is actually in implementing a couple of NetSuite partner apps. So they’re coming online. One is called PayStand, which is a US-based one, which will do our total, AR from go to whoa.

“And that’ll just free up our account and the guy who’s doing the backend stuff now. And then the other step is, I guess it’s understanding our costs. Like Robert would understand, the cost of shipping has gone through the roof.

“International shipping has gone up by 1,000 per cent. Domestic shipping in the US used to cost us say 60 bucks now cost us 400. They need about 80,000 truck drivers over there and 80,000 trucks and they’re not going to get them because no one wants to work from poverty.

“But at the same time, it’s a really interesting sort of dynamic. Our thing is really trying to pass that cost back to the consumer as best we can. And to do that we have to basically pull tools. So it’s things like providing real-time quoting that’s live on our website for consumers.

“We’ve helped people create businesses up and down the east and west coast of the US, where people are now running small courier companies because we’ve been able to give them enough business to survive.

“There’s a couple of guys who basically on the promise that we give them the business have bought a truck we’re paying them probably 600 or 700 grand this year to run our boards up and down the coast rather than do it with a shipping company.

“In Australia, we bought a sprinter van just because of the same thing. We had three QANTAS A380 pilots who were out of work. They’ve all gone back to work now. So now I’ve found a couple of other guys who are employment is up and down, so they’re running it.

“So just finding ways to navigate the supply chain issues we’re having at the moment. Just getting things on time is a real issue. In December, we normally have a rule that we don’t bring any containers into Australia or New Zealand.

“This year, we had 18 40ft high cubes come in. And none of that went out until January. So we pretty much missed half our December. But that’s all come in and gone out now.

“But it’s just those things like last year, I woke up every day and thought, “Okay, what’s the problem I’m gonna have to solve today.” Running a business at the moment is like that, you don’t know what the curveball is gonna be.”

Mark Pesce:

“All right, Robert, what about you for Easy Living Home Elevators, where to from here, what is the next landing pad for the business?”

Robert Pizzie:

“From a systems perspective, we’re launching a couple of extra modules, the CPQ module, which configure price quote, so that we can get pricing out to our customers sooner, and that it’s correct pricing, which goes back to that single source of truth.

“In a fairly technical product, like an elevator, there are lots of different options. And if you click the option, it flows right through to the customer offer, right through to the order. Whereas previously there were human error elements that could get in the way of that.

“So that’s almost ready to launch. Also, we’ve got another partner through [inaudible], which is building an intelligent service booking system.

“Because in the maintenance space, the way you maximise your profits is to maximise your efficiency, i.e. the minimum travel distance between each of the maintenance and break down visits.

“So there’s some mapping software we’re putting in place that does all the calculations for us. It’s very difficult to ask someone who is, say, based in Brisbane, to know that driving from Palm Beach in Sydney to Cronulla is a little bit further than what it looks like on the map. And you’ve got Sydney traffic to deal with. We’re pretty excited about that. We’re only a couple of weeks away from launching that.”

Mark Pesce:

“Brilliant. Okay, let me introduce Heidi, Heidi, you can deep cloak. Say hello to Heidi heck from dynamic business, everyone. Okay, Heidi, you’ve been? You have been monitoring the audience for their questions. What do you have for our guests?”

Heidi Heck:

“So I suppose I’ll start with you, Mark Kelly, what would you consider the absolute number one feature of NetSuite for your business?”

Mark Kelly:

“I think it’s just the usability of it. We were using MYOB that was tied together with a SQL database. And like Robert said before, getting the reports was sort of a historical event, by the time we got them, it didn’t matter.

“Now I pretty much run our P&L live. So for our end of the month, it’s the difference between the live dashboard and just a couple of journal entries. Now it’s no different to the speedo on the car. I’m pretty much looking at that every day.”

Heidi Heck:

Nice. And what about you, Robert, what would you say the number one feature of NetSuite is?

Robert Pizzie:

“Yes, similar, that single source of truth where you key in the data once and every piece of your business looks at it. But rather than having to double handle, and having that human error element coming into it. So that’s probably the single most important thing that I’ve found from having that ERP.”

Heidi Heck:

And Rob, what was the turning point to move to a more solid solution for you?

Robert Pizzie:

“Yeah, one thing was the length of time between when the monthly reports come out. And the fact that some of my great people were looking at me saying, “I can’t do this anymore. It’s too hard.”

“So that was a moment where I thought, I mean, when you employ people, you do tend to get close to some of them. And, you know, when these people who I respected and they respected me, and they were putting out a cry for help. I wasn’t really listening, because I’m saying, “How much is that going to cost?” But in hindsight, I should have made that decision much sooner.”

Mark Kelly:

You wouldn’t even think about what it costs now, would you?

Robert Pizzie:

“Well, I did because the old systems weren’t really costing us anything. And then you’re saying, Well, I’m not sure how much efficiency we’re going to get out of the system. But now that I know, yes, someone needed to give me an uppercut.”

Heidi Heck:

“So, Mark, now that you’re running with a very lean staff and a smarter infrastructure, do you find yourself looking at your business and kind of performing a business health check of sorts, examining what the systems you have in place, telling you?”

Mark Kelly:

“I think we probably did that in March, April, May last year. And now it’s about just, checking in with people and making sure that if there are things that are missing, or things that need to happen are. Also looking at the improvements that we can make.

“I think, for me, it’s all about improvements. My big thing in life is this question “might one plus one equal infinity?” So for me, that’s what I’m striving for all the time.

“There’s a lot of smarter people running businesses, and they see opportunities to help businesses. I think the big thing in life is really just working out where the information is.

“For me, it’s more about talking with other people, like, I’d love to go and have a beer with Robert, just sit down and share a couple of things, how we run our businesses, that’s how you learn. Not just it’s not obviously drinking the beer, it’s more about talking.”

Heidi Heck:

“Absolutely. So for both of you, this is the big question. How important has real-time financial data been in staying nimble as an organisation?”

Mark Pesce:

“Robert, why don’t you start off.”

Robert Pizzie:

“Absolutely vital. I have the key financial metrics on my screen every morning, I never had that, for the entire life of the business.

“It helps us to make much better decisions. We’re just even reshaping that even further. And the accounts team were actually looking to reduce that.

“There’s a couple of people here that want to move on, mostly because they’re mothers and they want to spend more time at home. So we’re looking at even further automation and simplicity in the system so that we need fewer people.”

Mark Pesce:

“Mark?”

Mark Kelly:

“You get to a point where it’s just inherent, you don’t even think about it, it’s no different to breathing. You probably didn’t think about breathing today. And that’s what NetSuite is.

“I think the same thing about this information that we’ve got, which is just live all the time, we can see how much inventory is in every warehouse and to stock planning and forecasting and cash flow modelling and all that stuff, it’s, it’s pretty much all there, and you don’t have to go searching for it. So it’s a big thing.

“I think the difference is it actually just blends the financial stuff into the operations of the business. And it just makes sense. You know, because finance is actually just a ruler that runs over your whole business. It’s a reflection of how you’re operating your business.

“But if you’re not running your business properly, then the financial thing will be from black to red. So the better you can operate your business, the better that financial stuff will be.”

Mark Pesce:

“Awesome. That is all the time we have for questions.

“Thank you very much, Heidi. Thank you very much, Mark. And thank you very much, Robert, for your incredible Insights.

“So, one of the things that we’ve been hearing consistently here is that businesses will go as long as they can with the tools they have until they make a decision to disrupt themselves.

“Sometimes that’ll happen because an employee leaves, sometimes that will happen because the system fails. But there are always some breakpoints there. And this is when businesses tend to look at themselves.

“But they probably should be doing this all along. And of course, the pandemic has been an amazing moment for a lot of examinations and self-examination around businesses.

“We know that there are transportation issues, there are logistics issues, there are employment issues, there are skill issues everywhere, as Mark said, Every day he wakes up, there’s a new problem to solve. And all of that means that the last thing you want to do is worry about the tools, you want to be able to know what the state of the business is.

“And you want to be able to do that quickly and efficiently. And in fact, Mark’s been able to do that so efficiently that he’s now working on about a quarter of the staff and getting the same amount of revenue.

“Robert managed to hold the line on new hires and continue to keep the business profitable in the middle of a very difficult time. So that means that the tools we should be looking for are not the cheapest tool, but for the tool that helps the business be the best, it can be.

“I’d like to thank Mark Kelly, again from global surf industries and Robert Pizzie from easy living home elevators for their time for their insights.

“I want to thank you for joining us for dynamic businesses, how to save yourself from a business system hairball sponsored by Oracle NetSuite to learn more about Oracle NetSuite and download a white paper which shows you how you can position your business for growth, visit the NetSuite website at netsuite.com

“Once again, I’m Mark Pesce, thanking you and wishing you a very good afternoon.”

Read more: Positioning your business for recovery – Oracle Netsuite webinar

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.