Square has expanded its range of secure payment solutions for Australian business owners, with the launch of two new APIs it says will reduce the complexity of accepting and tracking payments in-store and online.

The global payments technology company said its new API for e-commerce integrates with custom websites as well as pre-existing e-commerce shopfronts developed by ready-to-go website developers including BigCommerce, Weebly, Ecwid, WooCommerce and Wix, so that businesses can accept payments via Square’s online payment gateway. A flat rate of 2.2% per transaction for any Visa, MasterCard or American Express transaction applies to online payments processed through Square.

Meanwhile, Square said its API for point of sale (POS) enables businesses to integrate their custom-built iOS or Android POS platform with Square hardware, such as its contactless and chip reader. Card payments accepted in person using a Square hardware via applications integrated with the API for POS are charged at 1.9% per transaction for any Visa, MasterCard or American Express transaction.

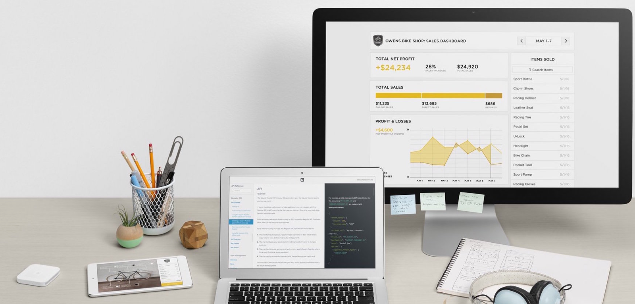

Square’s Australian Country Manager, Ben Pfisterer said it is free and simple for businesss to integrate Square’s APIs with their platforms, and that sales processed in-store and online via the APIs both show in Square Dashboard.

“It’s more common than ever for businesses of any size to sell their products or services online and in-person, so having a fully integrated omni-channel system gives them a powerful advantage,” he said.

“With Square, businesses can now accept payments through any channel and gain a single, holistic view of their business, which vastly reduces the complexity of having to navigate numerous, disparate systems.”

Pfisterer said the Melbourne-based technology start-up SwiftHero — whose app matches vetted tradespeople with those who need them — is the first business in Australia to employ Square’s new API for POS.

He explained, “Embracing Square’s API means tradespeople can now accept card payments right from the SwiftHero app using affordable and accessible hardware, while overcoming challenges of payments partnerships often experienced by start-up companies.”