Fintech startup Athena Home Loans has raised $15 million in Series A funding from Macquarie Bank, Square Peg Capital and Apex Capital for its cloud-native digital mortgage platform.

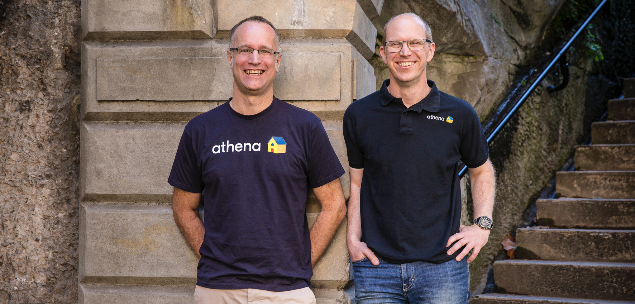

Athena, which previously raised $3 million in seed funding from Macquarie, Apex and Rice Warner, was launched in June 2017 by ex-bankers Nathan Walsh (CEO) and Michael Starkey (COO). According to Walsh, Athena is seeking to challenge the Big Four Banks dominance over Australia’s $1.7 trillion home loan market with its mortgage platform, which has its pilot-launch next month.

“Athena’s mission is to make the journey to home ownership faster, cheaper, and less stressful,” Walsh said. “To create the best mortgage experience and savings benefits to borrowers and investors, we’ll bypass the banks to connect borrowers to superfund-backed loans at much lower rates.

“Australians don’t need more debt. We need help to pay off our home loans faster. In as little as 15 minutes online, a borrower can apply to refinance their mortgage and get conditionally approved at a great rate.”

Walsh told Dynamic Business that he and Starkey are delighted to be backed by Square Peg Capital as well as their pre-existing line-up of investors Macquarie Bank, Apex Capital and Rice Warner.

“Investors with their gravitas provide us with value well beyond funding, both in terms of validating our business model and our credibility with consumers,” he explained.

“We are a challenger brand looking to shake up the industry and customers will want to know who is behind us. Having the investors we have helps customers trust we are here for the long term. Since our seed round, last year, Macquarie, Apex and Rice Warner have been incredibly generous with their support and insights. Our Series A is exciting both for the follow-on from our seed round investors, and to have Square Peg team joining the Athena journey.”

Walsh revealed the Series A capital will fund the pilot, launch and growth of Athena home loans, and ongoing innovation investment into the Athena platform. He added, “We absolutely plan to take on the dominance of the big four who own about 80% of the market. It’s time that customers have access to a true alternative, one that gives them value on all fronts – product, service and experience.”

Starkey said that Athena’s unique model will involve partnering with super funds to fund residential home loans.

“Today, superannuation funds have large investments in Australian mortgage assets, via bank intermediation,” he said. “By investing in home loans directly with Athena, super funds can cut the spread between what mortgage borrowers pay and investors receive. In countries such as the Netherlands, where pension systems are similarly advanced, the impact of this model is already evident.”

As part of Square Peg Capital’s investment, the VC firm’s co-founder Paul Bassat will join the Athena Board.

“We are thrilled to be joining Athena’s journey,” Bassat said. This is a great example of the type of team we love to back; smart, driven and focused on solving an important problem. The win-win model that Athena offers to investors and borrowers has huge potential to disrupt the way home loans are originated, serviced and funded in Australia.”