As the dust starts to settle on what has been an astounding US election, the question on everyone’s lips is how will global trade be affected?

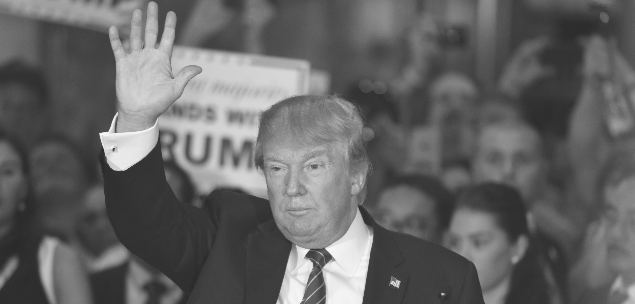

Let’s face it, the protectionist policies that helped propel Donald Trump’s vote in Middle America will have far-reaching consequences for the global economy and global alliances – if implemented. Nevertheless, we need to be alert to the potential threats and opportunities.

There will be winners and losers, and whilst I seriously doubt Trump will successfully implement 45% tariffs on Chinese imports, you can bet current trade policies are in for a rethink.

Threats to tear up Free Trade Agreements should not be taken lightly and proposed tariffs on imports to the US could trigger counter-measures from other nations.

On face value, it appears Trump’s trade policies will hit developing economies harder than they will developed economies.

Aside from his rhetoric on China, Trump’s criticisms of NAFTA, for instance, target Mexico far more than Canada; and following June’s Brexit vote, he said the UK would “always be at the front of the line” for a bilateral trade deal with the US.

The likely reality is that the bulk of Trump’s trade policies will be designed to protect and restore US manufacturing jobs from the competition of imports from cheap labour countries – thus appealing to his so called “deplorables” on a range of fronts.

Protectionist policies focused around supporting and protecting first and second stage “traditional” manufacturing industries (utilising local inputs) could be logical targets for the incoming President – making political sense in the “heartland” whilst still being palatable to 5th avenue.

The potential for other nations to implement retaliatory trade measures against a protectionist Trump is no doubt already being “war gamed” by governments around the world.

Resultant shifts in trade flows could provide serious windfalls for specific industries in some countries and Australia and New Zealand are arguably in the box seat in the Asia Pacific region – at least from a trade perspective. We have seen this previously in mini trade wars fought around commodities such as beef.

One of the SME exporters that hopes to benefit from a Trump presidency is PCT Global from Seven Hills in Western Sydney. The company, which manufactures and distributes EnduroShield easy clean treatments and surface cleaners, has been exporting to the US market for just over five years and now sells into a number of major retail chains.

PCT Global Managing Director, Craig Howard, said that EnduroShield’s clients in the US operate within the glass processing and home improvement industries.

“These customers have hope of a stimulated US economy in the wake of the election with many of them planning to invest for growth. As an exporter to the US, selling in US dollars, we would benefit from an appreciating US currency that could occur from any Trump stimulus package. It is our hope that there will be no detrimental changes to the trade agreements between the two countries which is unlikely given our current close ties,” he said.

The currency gyrations Howard alludes to will be somewhat more unpredictable – after all, who would have picked an appreciation in the US Dollar in the event of Trump’s ascendancy? That said, for the same reasons as outlined above, we probably should have guessed that the hardest hit currencies in the wake of the US election result have been in developing economies that trade heavily with the USA. For example, the Brazilian Real and the Mexican Peso.

The reality is that even before you start looking at the potential global security implications (and potential shifts in alliances) associated a Trump presidency, possible shifts in trade flows could have substantial impacts on the current world order.

There will be winners and losers as there always is in international trade.

About the author

Ian Smith is the CEO of CargoHound, an online marketplace for international freight that enables importers and exporters to source competitive freight pricing from ‘community rated’ service providers. Since launch in July 2015, the Sydney-based company has signed up over 940 importers and exporters and received aggregate freight quotes totalling more than A$5 million.