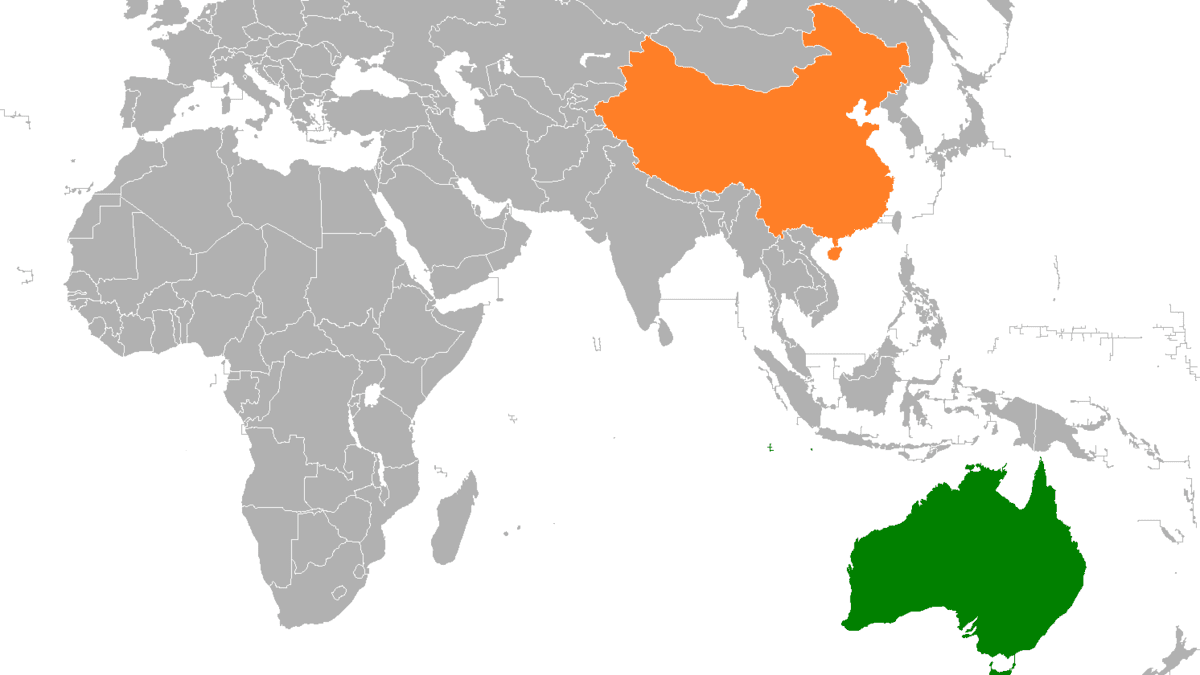

Small and medium-sized firms (SMEs), which make up 88 per cent of all Australian businesses, are advised by Australia’s peak industry body National Centre for Asia Capability, to be as Asia-capable as big business in order to flourish in the difficult Chinese market.

Research published by Asialink Business claims that Australian small and medium-sized businesses no longer rely on conventional business methods.

The survey, which identified 11 significant Australian companies in China across the food, fashion, health, and skin care sectors, discovered that Australian SMEs implementing creative techniques are still having success.

While political unrest, rising freight costs, and travel restrictions are difficult, it is becoming more crucial to beat local market competition and focus on a specific niche. The report discussed the difficult lessons learned by 11 Australian companies selling to China during the pandemic, including those in the food, fashion, health, and skin care industries.

Businesses with overseas reach achieving commercial success: survey

More than two-thirds (69 per cent) of small-to-medium Australian firms aim to be operating outside of Australia by 2027, according to new research from global fintech Airwallex.

According to the research, businesses already operating in international markets are succeeding financially. According to the poll, more than half of these enterprises are breaking even, which found that 2 in 5 (42%) of them are profitable (52 per cent).

The study also discovered that, despite ongoing economic difficulties, such as rising inflation and interrupting global supply chains, 96 per cent of SMEs that already conduct business abroad and 99% of those that intend to do so in the coming year experienced growth in 2017.

For SMEs trading overseas, the region where they have seen the biggest growth in sales and revenue was Southeast Asia. Almost two in five respondents (39 per cent) said this market had been their biggest revenue generator outside of Australia in the past year, closely followed by the U.S. (29 per cent).

memobottle is one Australian-founded business enjoying commercial success in overseas markets, with 50 per cent of its revenue now being generated abroad, mainly in the Southeast Asia region. In the past twelve months, the reusable water bottle movement has on-boarded distributors in Indonesia and Singapore and exhibited at trade shows in the U.S. and Europe.

memobottle Director and co-founder Jonathan Byrt cites the business’ focus on international markets as crucial to its success during the pandemic period. “Having a global presence during these tumultuous 24 months has allowed us to switch marketing and revenue focus between regions. Being in multiple markets unlocked opportunities for the business, which have allowed us to grow and expand. Our operations in China and the U.S. kept our revenue steady while Australia and Europe battled with sustained lockdowns and geopolitical events,” said Jonathan.

Similarly, Aromababy Natural Skincare has been exporting to China, Hong Kong, Singapore, Dubai and South Korea for 15 years. Founder Catherine Cervasio said her business would not have survived the domestic market had she not expanded overseas.

Reid Fruits is one of Australia’s largest cherry producers, exporting to over 20 countries globally. It has been exporting to China (its largest market) since 2008. Tony Coad said a major threat had been counterfeiters.

Meluka Australia is a food and beverage company that makes tea tree and honey-based products and has been in the China market since 2020. CEO Ben Rohr said bilateral tensions had had little impact on consumers. ‘Most Chinese consumers are not aware of the bilateral tensions between Australia-China.

“Australian SMEs are still achieving outcomes from China, based on prevailing consumer demand. Consumers recognise quality when they see it. Savvy Australian companies leveraging this demand have adapted their strategies and operating models to find success,” Asialink Business CEO Leigh Howard said.

“While Aussie SMEs don’t have the resources of big business when operating overseas, with innovative approaches many are achieving sustained growth,” said Howard.

“While it’s true big international brands are popular in China, interest in smaller overseas brands with unique offerings has taken off, with small and medium-sized producers of distinctive products leveraging the high regard international consumers have for Australia as a producer of safe, clean, and high-quality products.”

There is growing diversification and interest in new markets such as Southeast Asia and India, however, China remains Australia’s largest export destination and the biggest consumer market in the world.

“It has also become a more complex market for Australian businesses to trade, since restrictions were imposed on a range of imports, including barley, wine, seafood, beef and coal.”

“Australian SMEs operating in China need to conduct regular risk assessments to ensure they are comfortable with their short and long-term risk exposure.”

“Trade analysis and reporting frequently focus on key commodity sectors and how some of Australia’s largest companies have navigated this complex landscape. But the experience of SMEs has been largely flying under the radar,” Howard said.

RELATED READ: Opportunities abound in China for Aussie SMEs but on-the-ground relationships are essential

Link to ’Risk and Reward: Opportunities for Australian SMEs in China’, by Asialink Business

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.