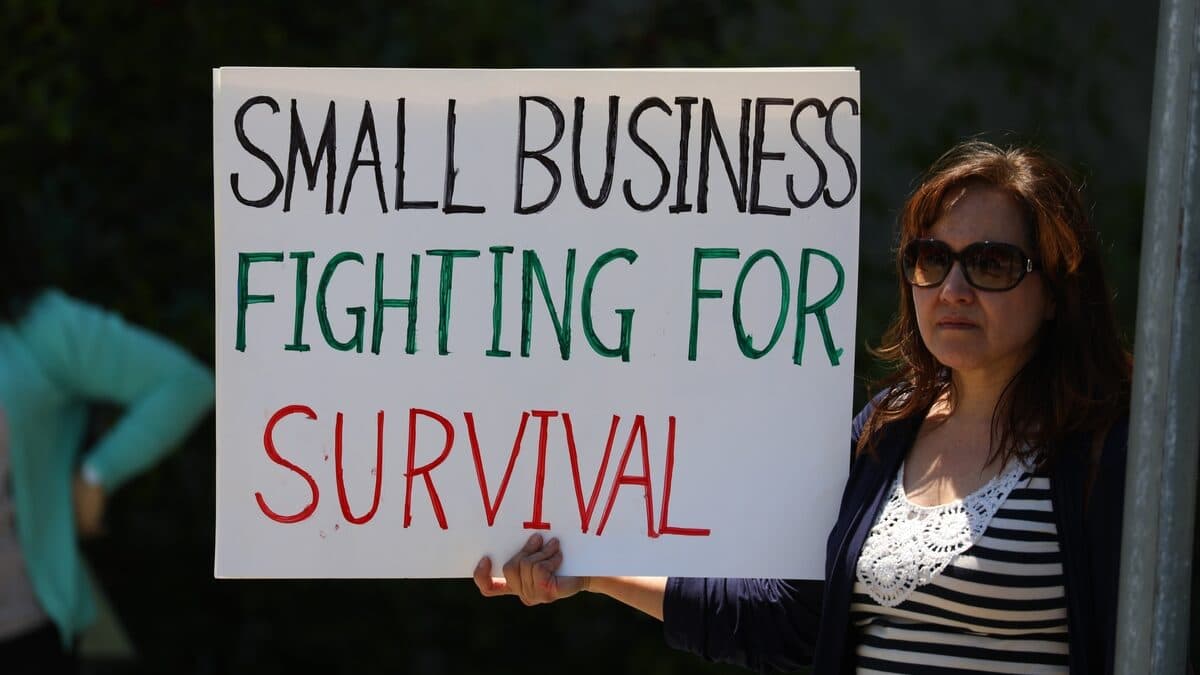

Cost-of-living insolvencies are on the rise as ‘date-night economics’ hits small business cash flow, says insolvency and business turnaround specialist Jirsch Sutherland. And while it’s a slow burn, numbers will increase, the firm warns.

Bradd Morelli, Jirsch Sutherland’s National Managing Partner says there has been “a noticeable shift away from predominantly tax-driven insolvencies”.

“According to the latest Alares Credit Risk Insights, the ATO is still the key driver of businesses being wound up and the big four banks continue to ramp up their Court recoveries. However, we are now handling more matters and receiving more inquiries from businesses that have a small but manageable tax debt yet their financial distress isn’t caused by ATO pressures; it’s more likely to be cash-flow issues,” Morelli says. “It’s not a seismic shift yet but these types of insolvencies are increasing, particularly as consumers cut back their discretionary spending. I call it ‘date-night economics’, with householders reassessing what they spend their money on and, among other things, not going out as much. And it’s having a real domino effect, with myriad small businesses experiencing a cash flow hit – on top of the higher cost of doing business.”

Morelli says that across Jirsch Sutherland, the team has noticed a significant uptick in insolvencies and small business restructuring within the hospitality sector – particularly cafes and restaurants – as well as retail and building trades. “Anecdotally, I’ve spoken with a number of building contractors in recent weeks and they’re all saying the same thing: their workloads have dropped from the highs of the COVID years as homeowners have tightened their purse strings,” he says.

And as eligible small businesses realise the benefits of Small Business Restructuring, this solution continues to gain traction, Morelli adds. “The latest Alares report showed that in August, SBRs were trending towards one-in-five of all insolvency appointments. Small Business Restructuring has had a positive impact on the economy since the regime was introduced, because SBRs provide much better returns to creditors than liquidations, they’re tax compliant, and they preserve jobs. Not only that, but with SBRs directors stay in control of their companies, and it’s a less invasive process than voluntary administration or liquidation. According to ASIC figures, of the 573 companies that entered restructuring after 1 January 2021 and had completed their restructuring plan by 30 June 2024, 89.4% remained registered.”

Compliance is crucial

While the majority of SBRs have been getting the green light from creditors – including the ATO, which is usually the main creditor – Morelli says he is now witnessing a perceptible change, with an increase in the tax office voting against certain SBR plans. “I understand there are three main reasons: director/shareholder loan accounts, trade creditors (except the ATO) being paid down prior to the appointment of the SBR practitioner, and poor compliance history,” he says. “Having good compliance history is one of the indicators the ATO uses to determine the viability of a company. If it doesn’t have a good history, it can be a red flag. That’s why it’s so important to be up to date with activity statements, tax returns and superannuation returns and payments.”

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.