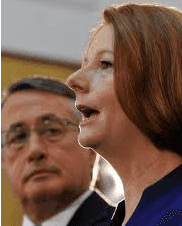

Julia Gillard has confirmed long-held speculation her Government will place a tax of $23 per tonne of carbon on the country’s 500 worst polluters, with the price to rise 2.5 percent per annum each year after 2012.

AAP reports Gillard said the policy is simple: the Government will make Australia’s 500 worst polluters pay a price per tonne for the carbon they release into the air.

“At the moment those big polluters can release that pollution into our atmosphere for free.”

According to Gillard, the tax (which is likely to cost $4.4 billion to implement) will cut some 159 million tonnes of carbon pollution by 2020, reducing Australia’s emissions by 5 percent. The tax will cover 60 percent of the country’s carbon pollution, apart from exempted agricultural and light vehicle pollution.

Models by the Treasury department show the tax would boost the consumer price index by just 0.7 percent in 2012-13. Gillard said the tax on big polluters wouldn’t flow on to voters, as many were concerned, revealing tax cuts for those worried about higher power bills.

Protections for various industries

Gillard also detailed assistance and grants her Government would be giving to ensure heavy polluting industries would survive the tax requirements, with approximately $9.2 billion to be spent on the steel and aluminium production industries over the first three years. This money will also be used to help shut down the oldest and worst-polluting power stations.

The worst emission emitting and trade exposed sectors will be granted free carbon permits covering 94.5 percent of average costs, with moderate emitting export industries to be given free permits covering 66 percent of average costs.

Loan guarantees will be set-up for electricity generators via the new Energy Security Fund, to allow the industry to refinance loans between $9 and $10 billion over the next five years.

The agriculture sector will be exempt from the tax, with the Government urging farmers and foresters to take part in its carbon farming initiatives and make use of its carbon offsets.

Overall, the carbon tax will bump up average household costs by $9.90 per week, with compensation to cover $10.10 worth of costs.

All motorists except heavy transport are exempt from the tax, with the tax-free threshold to be tripled to $19,4000 by July 2015, when emissions trading commences.

To placate angry voters, the government is also offering tax cuts to low and middle-income households as well as higher pension and welfare payments.

“No Australian will pay more tax as a result of these changes,” Gillard said.

Government modelling shows jobs will rise

At the same time Gillard detailed the carbon price and tax exemptions, her Government released modelling which shows Australia’s economy will continue to grow strongly whilst carbon pollution is being cut.

The ‘Strong Growth, Low Pollution’ report models the impact on the economy of putting a price on carbon pollution, and shows incomes and jobs will rise substantially alongside the carbon tax.

Average income per person under a carbon price is forecast to rise by about 16 percent by 2020, which equates to around $9,000 higher in today’s dollars. National employment is projected to increase by 1.6 million jobs by the end of the decade.

Government modelling also shows the cost of living impacts of a $23 carbon price are modest, with an overall price increase of 0.7 percent in 2012-13. That compares to a price increase of 2.5 percent after the GST was introduced.

“The price of most goods will increase by less than one half of 1 percent as the result of a carbon price. That is less than half a cent in every dollar. Delaying action on climate change will only lead to dramatically higher costs, will undermine our competitiveness and will ultimately hit jobs and living standards,” the report said.

“Putting a price on carbon will drive innovation and investment in clean energy technology, moving production towards less pollution-intensive processes.”

The report states that without action, Australia’s pollution is forecast to nearly double by 2050 and the carbon price will deliver an absolute reduction in emissions and drive the expansion of the renewable energy sector so that it is 18 times larger than its current size.