Even the most seasoned business owner finds it difficult to launch a new venture.

It can be tricky to calculate the costs involved, and it is often an adventure to predict economic factors that cannot be foreseen reliably.

While we feel that there is no tidy little price tag on your entrepreneurial dream, our experts have attempted to put together an estimate for our readers in this week’s edition of Let’s Talk to make budgeting easier and to understand common startup costs.

Let’s Talk.

Here’s our archive of the Let’s Talk Business series

Contribute to Dynamic Business

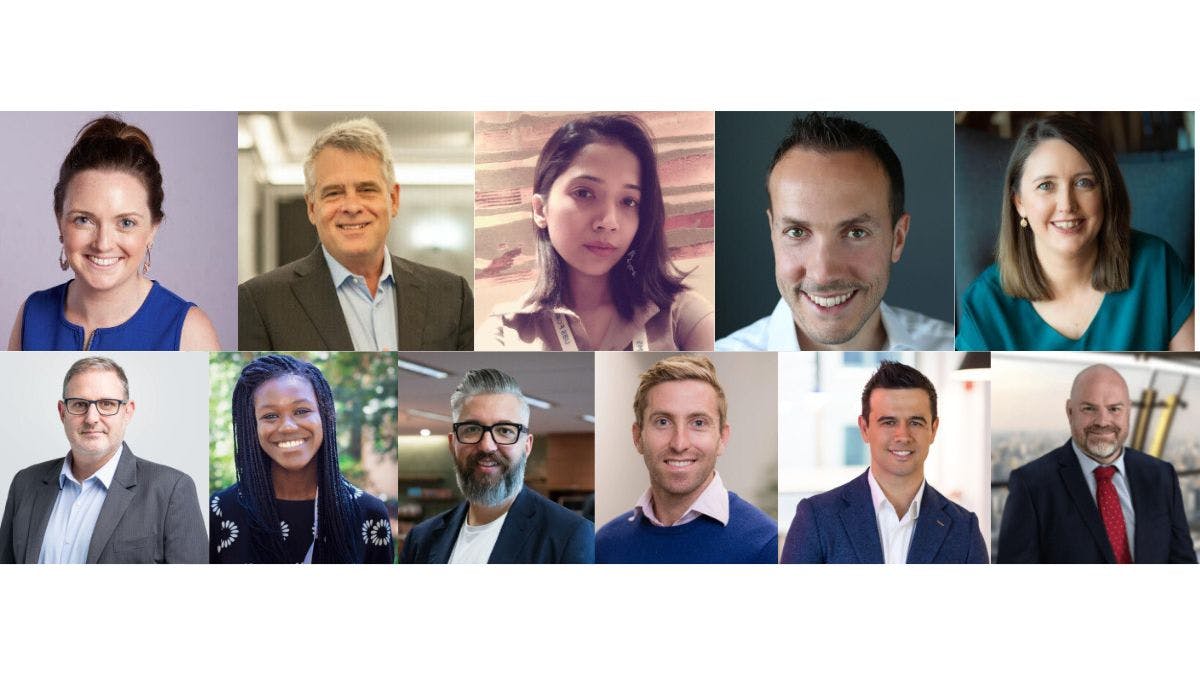

Johanna McCartney, Director of Accounting, BlueRock

“There are a number of expenses SME business owners should expect at the start of their journey. The key is to create partnerships where possible that can grow with you, and review, review, review! If you can trim the fat on your recurring expenses, it will improve your bottom line and free up funds to invest in other areas of the business to support your growth.

“These are my key tips on how to stay competitive:

- Insurance: Partner with a broker that can tailor a product appropriately; it’s important to have a clear understanding of what you’re covered or not covered for.

- Rent: Perhaps a landlord may be willing to provide a lease incentive or lower rent for the first year while you establish the business. If you are seeking office space, look at co-working or subtenant opportunities. This is a great way to keep costs down but still have access to an office when required.

- Utilities: Shop around. Reviewing regularly for new provider discounts and better rates will pay dividends.

- Software & Subscriptions: Avoid the subscription creep! A gradual build-up of unused or underused software subscriptions, memberships and licenses that go unnoticed can have a significant negative effect on an individual or company budget.

- Advisory services: Getting your structure correct from the beginning will save you significant dollars and pain down the track. Partner with a firm that can grow with you and consider outsourcing particular operational tasks such as bookkeeping, accounting and advisory, as it gives you the opportunity to scale up and scale down as cash flow requires.

- Payroll: Payroll is a significant investment, consider non-cash benefits for staff such as Employee Share Ownership Plans (ESOPs).”

Craig Dangar, Senior Partner Principal Consultant, Vault Group Accountants and Business Advisors

“We often say, prepare a budget and double it, but for a business starting out there are some costs to remember. Your company fees to ASIC are in the order of $300 a year and if you’re late on the payment expect fines and lots of them. As you are complying with your tax obligations you will be completing quarterly tax reports which will mean accounting or bookkeeping fees or software fees. Business insurances are a regular thing, especially statutory worker’s compensation coverage. A new business needs technology and for the most part understanding the cost of IT (and having a service plan) is often not understood until it is needed.

“Most importantly, most SME need to remember to pay the owner! All too often a new business owner forgets or doesn’t budget to pay themselves, you are the most important person in the business and you need to be rewarded.”

Sarah Agboola, CEO and Founder, mtime

“There are expected costs like paying a lawyer or accountant for the company set up, annual ASIC fees, insurance etc. but often people forget about how many software subscriptions you need to keep the lights on in your business. Domains often have annual costs attached to keeping them, as do website security licences, and hosting. Email addresses are monthly expenses to keep an eye on, and if you’re planning to use tools to manage your customer base, send email campaigns or even just have video chats on Zoom or Teams – those are all additional costs that can add up very quickly and if you’ve not budgeted for them can come as a surprise.”

Charlie DeWitt, Managing Director ANZ/SEA, UKG

“At any stage in a business’s lifecycle, spending on employees will be one of largest recurring variable expenses. Small and medium-sized enterprises (SMEs) can best control this cost by maximising efficiency through strategically allocating staff to meet demand without sacrificing the quality of service delivered.

“By adopting digital workforce management and scheduling solutions that enable data-driven decisions, business leaders can ensure the right people are in the right roles at the right time while adhering to compliance and safety standards. Digital workforce management solutions let managers make intelligent staffing decisions by rostering employees based on demand, ensuring shifts are adequately covered using forecasting capabilities and artificial intelligence-driven insights to streamline operations and prevent employee burnout. These solutions also enable managers to access richer data about the business and its processes and help identify new ways to maximise productivity.

“People play a crucial role in driving business success and by implementing workforce management solutions, SMEs can increase productivity, empower their employees, and control labour costs.”

Matt Aldridge, Principal Solutions Consultant, OpenText Security Solutions

“Small- and medium-size businesses (SMBs) are a prime target for ransomware attacks. This means cyber resilience must be at the forefront of all SMBs’ recurring expenses. Encouragingly, OpenText Security Solutions’ Global SMB Ransomware Survey found 33 per cent of Australian small businesses’ annual cybersecurity budgets ranged between $20,000 and $50,000, yet our research also revealed two-thirds are worried about their budget shrinking with rising inflation rates.

“The fear of looming budget cuts puts SMBs in a vulnerable position considering the state of Australia’s cyber landscape. To alleviate these fears, SMBs must stay one step ahead of malicious actors. This requires a multi-layered approach to cyber resilience that includes threat prevention, detection and response, recovery, and compliance.

“Bad actors have shifted their focus to users in an attempt to gain access to environments and move laterally. Email remains the most popular and easiest attack vector. Phishing attacks pose a substantial risk to organizations of every size. And while defenses have evolved, so too have threat actors which creates an urgent need for ongoing security awareness training for users. Ransomware is another issue that shows no signs of slowing, especially for SMBs. Unfortunately, many SMBs are not prepared to recover from a ransomware attack. Having a backup solution is a good start, but alone it is not enough. A strong incident response plan and regular testing are essential elements to recover from ransomware—or any type of disaster—with minimal downtime.”

Shannon Karaka, Head of Expansion ANZ, Deel

“Finding and retaining good talent is one of the biggest upfront and ongoing costs for any business, but it’s also one of the most important things to invest in and get right. Many businesses are finding success by adopting a global approach to hiring to overcome ongoing skills and talent shortages. It’s also become a more common way to grow a team, as remote and flexible working styles become more prevalent. In fact, Deel’s H2 Global Hiring Report found Australia is the APAC country with the most organisations hiring overseas remote workers. There’s other benefits to global hiring too, such as being able to strategically expand into key markets, the flexibility to provide round the clock coverage across time zones and improved employee satisfaction, with one survey finding 71% of respondents would pass up a promotion in return for being able to work from anywhere, at any time.”

Natasha Rock, Remote Support Group Lead APAC, GoTo

“When small businesses start out, there’s a variety of recurring expenses that are necessary for growth, especially in a new hybrid world increasingly dependent on technology. Small businesses need to ensure the right budget is allocated to ensure productivity, communications, and cybersecurity, which means recurring investments into communication technology, IT support and employee devices.

“A recent survey by GoTo found that 38 per cent of Australian businesses hadn’t updated their IT support in the last two years. Promisingly, however, more than half (53%) of Australian businesses update technology at least quarterly. For small businesses, it is important that devices and support are regularly updated to ensure a high-quality workplace for employees, and to protect the business from the growing cyber threat landscape.

“For small businesses, as they focus on enabling employees and the organisation to succeed and grow despite tighter budgets, investing in a consolidated technology platform that is fit-for-purpose to support and secure their flexible work set-up is all the more critical in managing the bottom line in uncertain times.”

Matt Richardson, Senior Corporate Dealer, OFX

“For start-up SMEs considering engaging with overseas suppliers and/or consumers, foreign exchange (FX) planning is often an overlooked aspect that could help minimise financial pain in the long-term.

“Though managing FX may seem like a drain on time and resources, SMEs operating in overseas markets may be losing money due to currency fluctuations and unexpected conversion fees every year. Understanding the impact of currency volatility and adjusting business finances accordingly, could mean the difference between competitive growth and leaking hard-earned profits. And getting this right from the beginning can position you well in the long-term when adding further global suppliers or layers to your business.

“The weak Aussie dollar that we’ve seen for a few months now could mean paying more for overseas goods than originally planned . Implementing tools such as Forward Contracts (option to fix a rate) and Limit Orders (option to set a target rate) from the outset, can help manage currency volatility and provide some more certainty on costs.”

Karen Kirton, HR Partner, Adviser, and Coach, Amplify HR

“As soon as you are ready to hire your first team member, owners need to consider recurring people related expenses.

- Recruitment: agency fees or job board ad spend

- Rewards and recognition: bonus structures and ongoing recognition items for top performers such as gift cards

- Training and Team Days: regular training to upskill team members and meeting room hire and catering to get everyone together

- Work tools: Laptops, desks, phones and software. If working in a hybrid way, then you will need to set this up in the office and duplicate it for their home

- WHS Compliance: The yearly workers compensation insurance fee, plus options for being proactive with safety such as Employee Assistance Programs (EAP).

- HR Compliance: On-demand HR consultants can keep your business compliant with employment related documentation such as policies and employment contracts you need, along with advice for those curly employee questions or issues.”

David Britten, Managing Director APAC, Corpay Cross-Border Solutions

“Australia’s growing inflation, volatile exchange rates, and constantly shifting global market landscape is significantly impacting the cost of cross-border payments. Small and medium-sized enterprises (SMEs) that operate in a cross-border environment or want to shift into international transactions and markets should be acutely aware of the costs associated with the foreign exchange process.

“The fees involved in a cross-border payment are notoriously high and can be invisible on either side of a transaction, often catching SMEs off-guard, especially when just starting out. These fees can affect cash flow and global trading partner relationships and can devastate a business’s bottom line.

“One of the best ways to avoid excessive processing fees in international payments is to use a specialist cross-border payment solutions vendor to help navigate the complexities of global trade and protect organisations against unpredictable currency fluctuations and fees. With the expertise of a cross-border payment specialist, SMEs can simplify how they connect with the global marketplace and move money anywhere in the world, minus the hidden costs.”

Merlin Luck, Regional Vice President of Small and Medium Business, Salesforce

“Setting-up a small business is no easy task and many owners today are under increasing financial pressure to manage ongoing expenses, including payroll, marketing and inventory, to name a few. In today’s new economy, small businesses need to find ways to automate many of these core business processes to drive organisational efficiency.

“By implementing a customer relationship management (CRM) platform, SMEs are able to create a single view of all of their data, which helps to streamline operational processes, as well as drive a greater return on investment on their marketing campaigns. According to Salesforce’s Small and Medium Business Trends Report, 56% of growing SMEs have already adopted a CRM to increase productivity.

“Thanks to Salesforce, local perfume retailer ‘who is elijah’ now has a single view of all of its customers, orders, inventory, influencers and suppliers, in one place. The solution includes streamlined management of customers’ orders, so staff no longer need to spend time sorting orders and printing labels. As a result of the newly streamlined process, the brand saw a 500% increase in sales in just 6 months, as well as an average of $6,000 of savings per month.”

Discover Let’s Talk Business Topics

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.