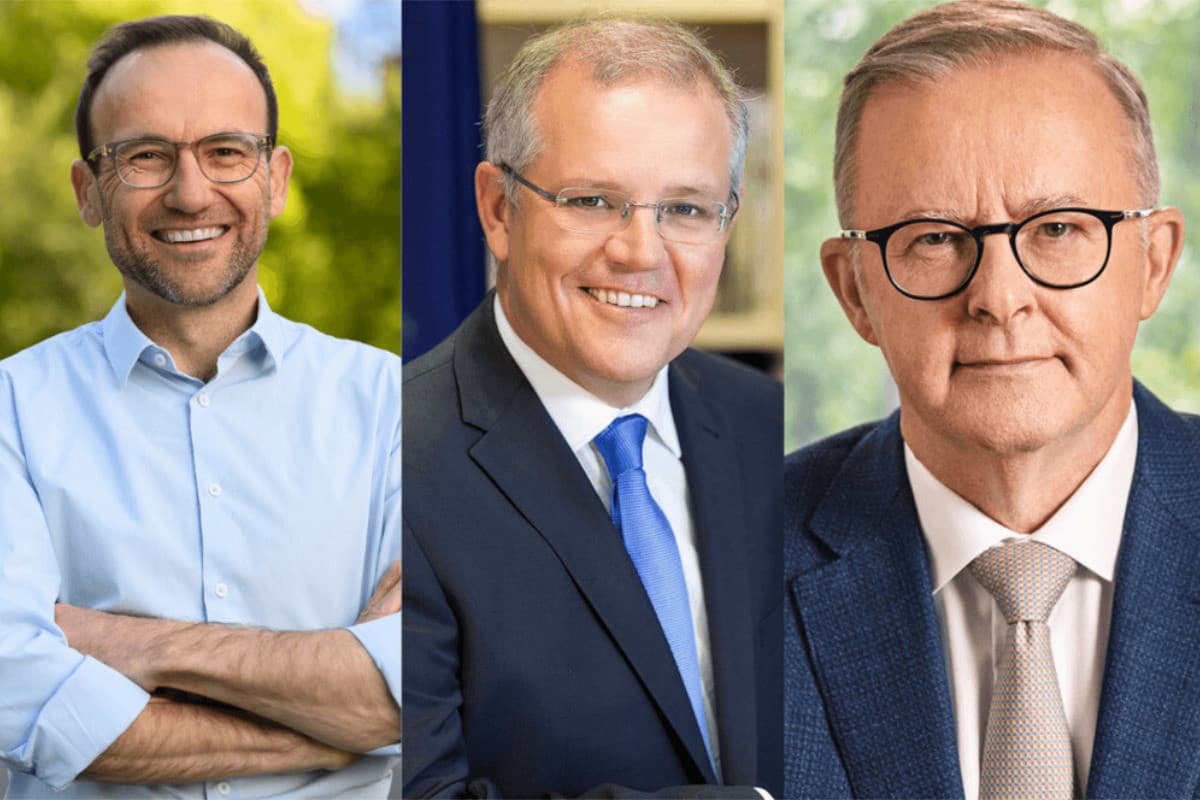

With billions of dollars promised across the board on the campaign trail, it can be hard for any voter to keep track. To help you out, we’ve compiled a comprehensive list of the policies put forward by of some of Australia’s major political parties that are revelant to SME owners. What are their plans for taxes? What’s the path ahead for manufacturing?

Dynamic Business breaks it down for you.

Australian Labor Party (ALP)

On jobs and skills

- 465,000 fee-free TAFE places for Australian students studying in industries with a skills shortage

- up to 20,000 extra university places over 2022 and 2023 with priority areas being education, health, clean energy, advanced manufacturing, and areas with skills shortages

- $100 million to support 10,000 New Energy Apprenticeships

- $10 million in a New Energy Skills Program to tailor skills training to meet the needs of new energy industries

- will ensure one in ten workers on major government projects is an apprentice, trainee or cadet

- will establish Jobs and Skills Australia to drive VET education and strengthen workforce planning

- will create 340,000 new jobs in the tech sector by 2030

- will deliver a dedicated Agriculture Workers Visa that will also provide protections for workers

On manufacturing

With a $15 billion National Reconstruction Fund:

- up to $3 billion to invest in waste reduction, green metals (steel, alumina and aluminium); clean energy component manufacturing; and hydrogen electrolysers and fuel switching

- $1.5 billion Medical Manufacturing Fund to boost medicine and vaccine production

- $1 billion to expand and innovate the processing of raw materials in Australia

- $1 billion to expand Australia’s critical technology capability, in areas like robotics, artificial intelligence, and quantum computing

- $1 billion in advanced manufacturing in sectors like defence, medical science, renewables, food processing, and low emission technologies

- $500m for investment and trade opportunities for Agriculture, Forestry, Fisheries, Food and Fiber

With a Buy Australia plan to ensure more government contract opportunities for local businesses over international businesses:

- create a Fair Go Procurement Framework for those gaining government contracts to pay their fair share of tax

- provide more opportunities for First Nations businesses

- establish a Future Made in Australia Office for local industry to take advantage of government purchasing opportunities

- strengthen the capability of the defence industry

On taxes

- minimum 15% tax on multinationals

- limiting debt-related deductions by multinationals at 30 per cent of profits

- legislated tax cuts that benefit everyone with incomes above $45,000

- increase in the low-and-middle income tax offset by $420 this year

On small business

Through a Better Deal for Small Business:

- Ensure a mechanism for small businesses to receive payments within 30 days

- Improve the negotiation power of SMEs with large partners by making unfair contract terms illegal

- Reduce transaction costs at the point of payment with a clear timeline for implement least cost routing or similar

Liberal-National Coalition

On jobs and skills

- $2.8 billion in the 2022 Budget to support Australian apprenticeships through $5,000 payments, with $15,000 wage subsidies to businesses who take them on

- $3.7 billion to support an additional 800,000 training places

- $49.5 million to expand JobTrainer Fund, contingent on matched funding from the states, to provide an additional 15,000 free or low-fee places to support Australia’s aged care workforce.

- create another 1.3 million jobs by 2027, with more than one in three of those jobs in regional Australia

On small business

- establish a small business unit in the Fair Work Commission to help SMEs navigate their workplace obligations

- $10.4 million to enhance and redesign the Payment Times Reporting Portal and Register

- strengthen protections for SMEs and consumer against unfair contract terms

- stronger penalties for breaches under the Franchise Code of Conduct

- $4.3 million to a new Franchise Disclosure Register

- $100 million to assist Australian exporters with the Export Market Development Grants program

- $4.6 million partnership with Beyond Blue for free mental health support to SMEs

- $2.1 million to extend the free Small Business Debt Helpline

- $8 million to the Australian Small Business and Family Enterprise Ombudsman

- support the Boosting Female Founders Initiative to provide grants to majority women-owned and led start-ups

- $60 million Powering Business grants program to support SMEs upgrading to energy-efficient equipment

- SMEs with an aggregated annual turnover of less than $50 million) will be able to deduct an additional 20 per cent of expenditure incurred on external training courses provided to their employees

- create 400,000 small and family businesses over the next five years

- $17.9 million to the Business Energy Advice program

On manufacturing

- support small and medium manufacturers through grants from the Manufacturing Modernisation Fund

- $22 billion in renewables and low-emissions energy technology

- $2.5 billion towards the Modern Manufacturing Strategy

- $53 million to establish the Australian Animal Health and Manufacturing Innovation Hub

- $750 million towards National Manufacturing Priorities: medical products, food and beverage, space, recycling and clean energy, defence, and resources technology and critical minerals processing

On taxes

- businesses with a turnover of less than $50 million can access a 20% bonus tax deduction on the costs of external training for employees and a 20% bonus tax deduction on investing in new technology like web design, eInvoicing, and cyber security

- for unincorporated businesses with a turnover less than $5 million, the tax offset has increased to 16% (capped at $1,000)

- keeping taxes below 23.9 per cent of GDP

- $1 billion to ATO’s Task Avoidance Taskforce to address multinational tax avoidance

- provide $1.6 billion in tax relief to SMEs over next four years

On tech

- $5 million in seed funding to develop a technology skills passport in partnership with the Australian Technology Network of Universities

- 30% Digital Games Tax Offset to boost the domestic digital games industry

- work towards target of at least 40 per cent women in the tech workforce by 2030

- $2.2 billion to support university and industry collaboration

- $1 billion Technology Investment Boost to encourage SMEs to go digital

- $101.7 million to strengthen biosecurity and traceability systems in industries

Australian Greens

On sustainability

- $15 billion “Made in Australia” Bank and manufacturing fund

- a $50 a tonne price floor for farmers engaged in carbon farming to help them transform their businesses through guaranteed returns for their carbon credits

- $25 Billion FutureGrid fund to enable the rewiring of Australia

- wage subsidies for up to 10 years to businesses employing workers transitioning from the coal industry

- grants of up to $25,000 and low interest loans of up to $100,000 for SMEs to replace gas-fired boilers, water heaters and cooktops with electric alternatives

- subsidise batteries by up to $10,000 for SMEs

- create Power Australia, a 100% publicly owned non-profit corporation which will offer all businesses at-cost electricity

On taxes

- 6% annual tax on the global net wealth of Australia’s 122 billionaires

- 6% annual tax on the net value of assets owned by foreign billionaires whose net holdings of Australian assets is greater than $1 billion

- set the minimum wage at 60% of the full time median wage

- 40% super profits tax on corporations with more than $100 million in turnover in Australia (including Australian share of a multinational’s operations overseas)

- minimum corporate tax rate of 25%

- repaying of JobKeeper payments by companies earning over $50 million who remained profitable or paid executive bonuses

- non-refundable tax offset of 20% for companies that hire STEM PhD students or equivalent graduates in their first three years of employment

On jobs and skills

- create 45,000 new ongoing direct jobs and 90,000 new ongoing indirect jobs in construction and services

- reform Australian Consumer Law to make it easier for consumers and/ or their respective agents to get refunds

- introduce industry code for airlines, travel and tourism businesses taking money from Australian-based consumers

- guaranteed leave, including sick leave, for all workers regardless of their status

- guarantee annual award wage increases of CPI + 0.5% in women-dominated industries

- low interest loans and procurement targets for women-led businesses

READ MORE: Election 2022: Both major parties need to work harder to support Australian households