A national business poll has been released showing one in three SMEs are considering closing or selling their business within the next six months, due to the impact of the COVID-19 recession, unless there is a significant improvement in conditions.

The poll conducted by ScotPac, Australia and New Zealand’s largest non-bank SME lender, has also shown that the business sentiment for the SME sector is still pessimistic, due to business uncertainty for the near future.

The poll has also shown that smaller businesses, with an annual turnover of less than $5 million, have also felt the impacts of the recession, with 40 per cent of those polled saying they are looking to sell and close by April 2021, if business conditions don’t improve significantly.

ScotPac CEO Jon Sutton said the research results serve as a warning for the small business sector, even though business conditions are brighter than they were earlier in the year.

“The research shows just how much so many within the small business sector have been hurting,” Mr Sutton said.

“Victoria is now out of lockdown and small business owners may be more optimistic than last month. However, these findings serve as a warning of the precarious position for many SMEs if another lockdown occurs or significant border closures remain in place.”

Uncertainty caused by the recession has also made the creation of funding plans harder for SMEs.

The research shows that 41 per cent of smaller SMEs have no idea how they will fund their business for the next six months. They are either unsure how they will adapt or unable to plan that far ahead.

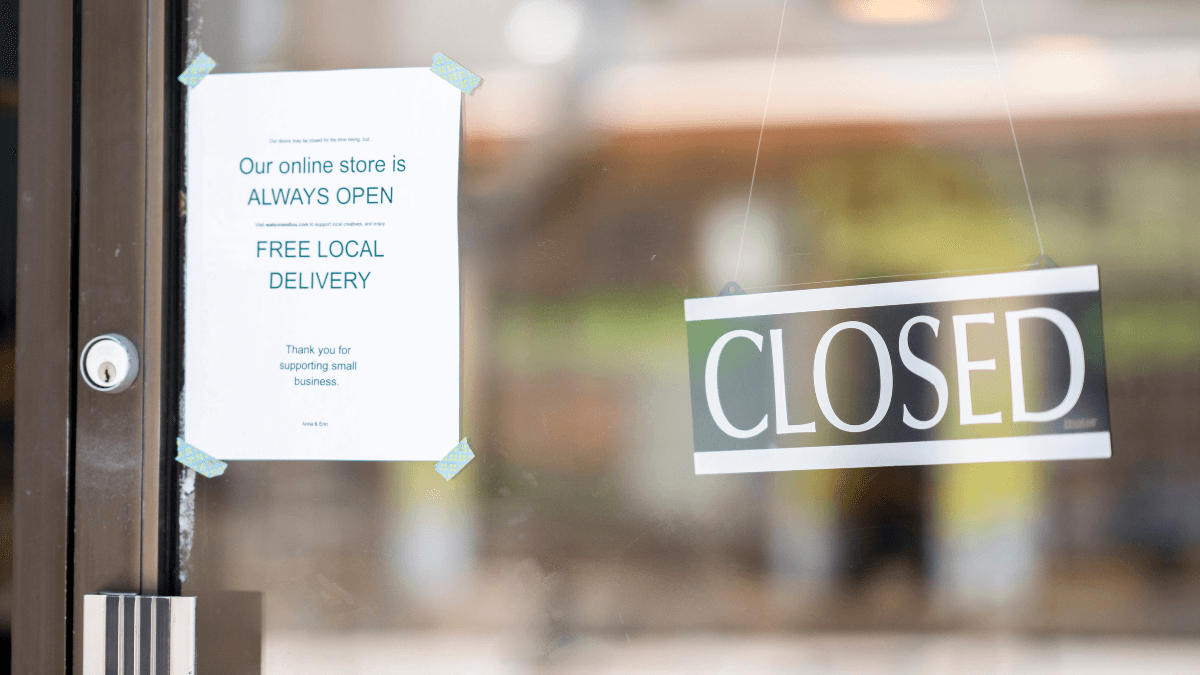

The retail sector, among other business sectors, has shown the most pessimistic business outlook.

Only around 10 per cent of retail businesses were certain that they would continue to operate as usual for the next 6 months. The rest are either considering selling, closing down, or unsure what they would do.

Mr Sutton said the manufacturing and wholesale sectors have also felt an impact, transport and business services have been resilient, while SMEs in the mining sector remain relatively unaffected.

90 per cent of mining businesses indicated they would continue moving forwards, according to the poll.

While the business sentiment is low for SMEs, the research has shown there is also no material change in demand for borrowing.

According to the four-week poll ending October 9 2020, 28 per cent of SMEs are still relying on government stimulus, while 28 per cent are not requiring government assistance at all.

“Given more than a quarter of SME respondents were covered by the stimulus, it’s important to consider what impact its withdrawal will have between now and April 2021,” Mr Sutton said.

“This is an issue that small business owners should take seriously. The financial aftermath of the COVID crisis is a call to action for SMEs to make the hard decisions about their business – how viable it is, what happens when ATO debts are enforced, and other debts fall due, how to deal with the end of JobKeeper, and the best way to fund the business.”

The government has extended government stimulus payment JobKeeper until 28 March 2021, but have tightened the JobKeeper wage subsidy payment rule, and the amounts are reducing gradually.

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.