Tech Tuesdays is a weekly column in Dynamic Business highlighting businesses and products revolutionising the tech industry.

The latest edition of Tech Tuesdays explores fintech solutions that can benefit small businesses. By using payment and accounting tools together, businesses can automate and streamline their financial operations, which can help them save time and money, reduce errors, and make better-informed financial decisions.

Additionally, having both payment and accounting tools in place can help businesses to identify and prevent financial fraud, reduce the risk of errors, and increase the accuracy of their financial data. This in turn, can help businesses to improve their financial performance and achieve their financial goals.

However, the sheer number of options can make it difficult for merchants, especially small businesses, to choose the best payment solution for their needs.

Today’s edition of Tech Tuesday aims to assist small business owners in making informed decisions about their payment options.

Let’s begin!

Pin Payments

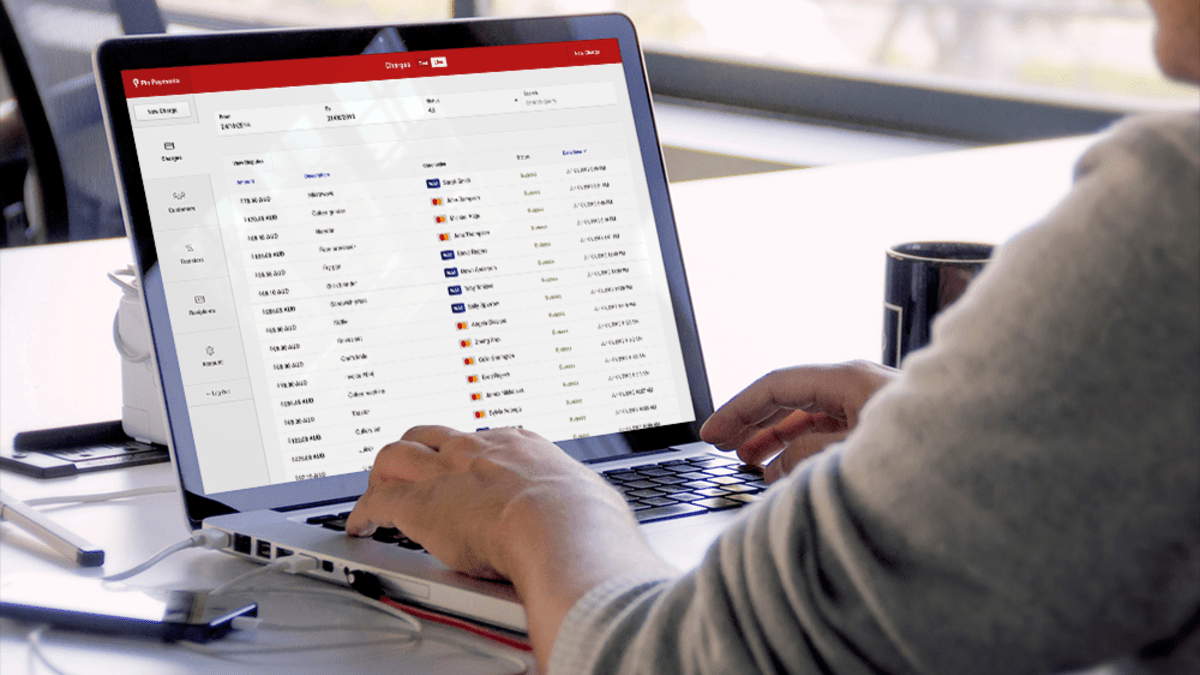

Pin Payments is Australia’s first unified payment approach for small to medium-sized businesses. It supports over 12,000 companies in Australia and New Zealand to online payments from debit and credit cards bearing the Visa, MasterCard and American Express brands without requiring a merchant account.

Pin Payments supports integrations with platforms such as Ecwid, Xero, WooCommerce and Shopify. Small to medium-sized businesses can sign up for Pin Payments with a quick online process and start taking payments immediately to get paid. Pin Payments make every facet of running a business easier, in order to access funds in a streamlined process.

For more, visit pinpayments.com

Square

This popular payment processing solution allows businesses to accept credit and debit card payments in person, online, and over the phone. It also offers features such as invoicing, point-of-sale (POS) systems, and inventory management.

More here.

PayPal

This well-known online payment processing service allows businesses to accept customer payments using various methods, including credit and debit cards, bank transfers, and PayPal balances.

More here.

Shopify

This comprehensive e-commerce platform includes a payment processing system that allows businesses to accept credit and debit card payments and other payment methods such as Apple Pay and Google Pay.

More here.

QuickBooks Payments

This payment processing solution is integrated with the QuickBooks accounting software. It allows businesses to accept credit and debit card payments and ACH bank transfers.

More here.

Kofax

With Kofax AP Automation, invoices can be submitted, received, reviewed, exchanged or approved regardless of the input channel. It also connects business-critical enterprise and procurement systems, workflows and data with pre-packaged connectors and APIs. And at the same time, it collaborates and quickly resolves exceptions and approvals while gaining greater transparency into how invoicing processes are executed.

With solutions to automate how you capture invoice data and code and verify invoices, businesses easily comply with the Payment Times Reporting Scheme, and Kofax has a portfolio of automated systems to assist you in implementing a straightforward and automated system.

More: https://www.kofax.com/workflows/finance-accounting/invoice-processing

Xpect

The newly launched Xpect Platform for Australian SMEs combines business operations, enabling management, communication and reporting across every business function, including finance, payroll, marketing, sales, website, and human resources.

Successful SMEs outgrow accounting systems yet find global ERP solutions that are not feasible, given the cost and time to implement. Software company CIBIS developed Xpect as a practical, fit-for-purpose alternative.

Leading Australian business software advisor Matt Paff coined the “SMERP Dilemma”, the chasm that exists between SME solutions like Xero and MYOB AR and ERP systems like MYOB Advanced, NetSuite and Microsoft Dynamics.

Payapps

Founded in 2011, Payapps is a cloud-based collaboration tool for the construction industry. It helps main contractors and subcontractors simplify and expedite project progress payment approvals, including variations and retentions.

A simpler and faster digital process ensures greater transparency, increased accuracy, improved compliance, reduced financial risk, fewer disputes and fairer outcomes. Payapps significantly cuts progress payment processing time, helping to meet regulatory requirements.

Compliance is improved and made easier with documentation verification integrated with the approval process. Seamless integration with a wide range of construction project and financial management software helps provide real-time data on all project payment requests and approvals.

More: https://www.payapps.com/

Shift Trade

The archaic trade term process means suppliers often act like banks by carrying unpaid customer invoices, wearing the risk and tying up cashflow. Shift Trade tackles this issue.

Shift Trade is a platform that allows suppliers to automate the management of their customers’ trade accounts and receivables. It helps streamline the trade payment process by eliminating paper-based trade applications and manual ordering processes while reducing the credit risk businesses wear for their customers.

Suppliers have certainty of payment and less time spent on administration, while their customers access more flexible payment terms that suit them.

Suppliers can get started at no cost to them by registering online in less than five minutes. Once registered, suppliers can invite their customers to join, track their available trade credit limits and start billing.

More here.

GoCardless

GoCardless is a global leader in direct bank payments, enabling vendors to collect instant, one-off payments or automated recurring payments without the usual chasing, stress or expensive fees.

The company serves a variety of customer segments; the sophistication of GoCardless’ technology and interface means its offering is secure and robust enough to service large-scale multinationals yet accessible enough for small businesses to take control of their payments, improving metrics from cash flow to conversion.

GoCardless is also the first international payments company to become ‘PayTo ready’, allowing users to access the account-to-account payment network set to replace Direct Debit. This means GoCardless customers can utilise faster and more secure transactions than traditional payment methods.

More here.

Wiise Accounting and Financial Management

Wiise is an award-winning business software helping Australian organisations streamline their accounting and operations and use real-time insights to accelerate growth.

Built on Microsoft Business Central with localised features to meet Australian banking, tax, and compliance requirements, Wiise’s powerful accounting package includes general ledger, accounts payable, accounts receivable, purchase and sales invoices, and a Chart of Accounts specifically designed for Australian businesses.

To find out more, head to https://wiise.com.

Lightspeed Payments

Lightspeed Payments is an integrated, contactless payment solution that allows hospitality and retail business owners to process customer payments directly from their point-of-sale, which reduces double handling, risk of errors and administration. Launched in Australia in mid-2022, Lightspeed Payments combines the two basic needs of every venue operation, processing orders and taking payments, into one system for a seamless ordering and less cumbersome admin experience.

When used alongside Lightspeed Restaurant, the solution uses data to deliver clear and actionable insights to restaurant operators, helping them make smarter decisions about their business.

The product enables merchants to take orders or make sales and accept contactless payments anywhere: curbside, tableside, at the counter and mobile. With one source of data and one company to trust, retail and hospitality operators can manage their omnichannel businesses in one place with an integrated experience. Set up is simple, fast and frictionless with transparent pricing – no hidden fees attached.

Flexible Pay Day

HR fintech Paytime launched in Australia in 2021, providing a technology platform that allows employees to access a portion of their earned wages at any time during the month. It plugs seamlessly into a company’s payroll software and accesses real-time information about their wages.

The integration is simple; the platform easily integrates with Payroll and Timekeeping systems utilising Application Programming Interface (API).

Employees can typically withdraw 50%-70% of their earned wages, which are received within minutes, into their bank account. Paytime is suitable for any industry as it runs seamlessly in the background and requires no change to payroll.

Stripe

This popular payment processing solution offers a wide range of business features, including accepting credit and debit card payments, processing ACH bank transfers, and issuing invoices.

Stripe uses tokenisation to secure payment details and keep sensitive data out of systems, helping businesses meet industry-wide security guidelines.

For more: https://stripe.com/en-gb-my/guides/introduction-to-online-payments

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.