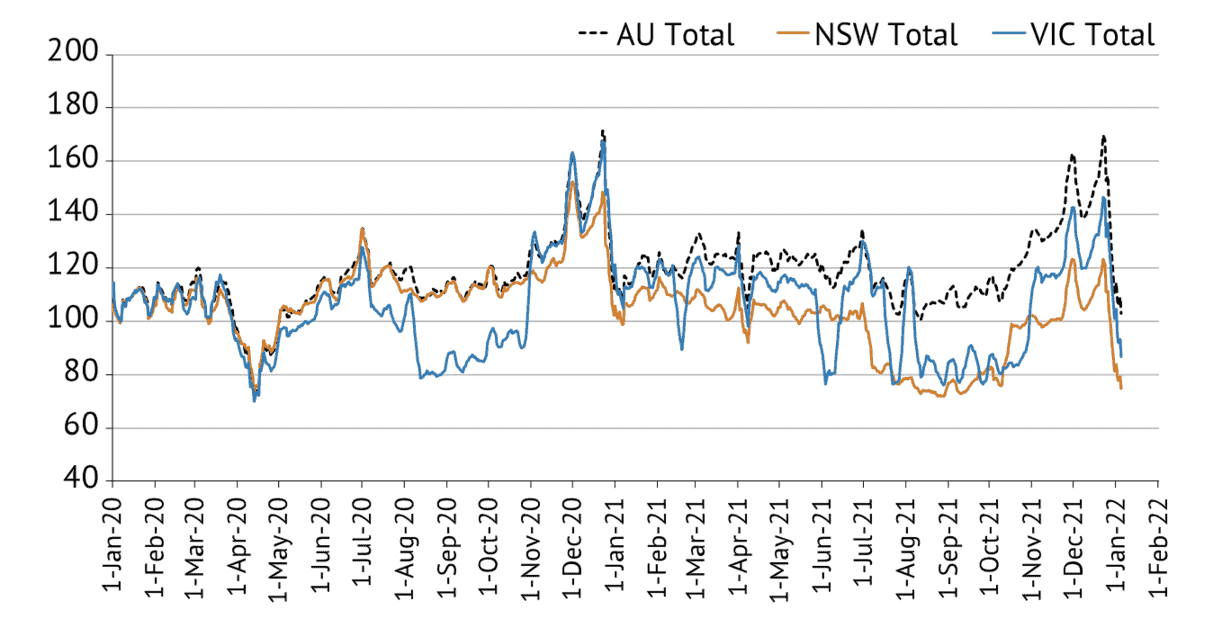

Despite government-ordered lockdowns being lifted nationwide, data from ANZ bank shows Australia is in the midst of a self-imposed lockdown.

In the week to January 5, the amount of money handed over traditional and virtual counters hit its lowest since the months’ long Delta lockdowns.

Where spending was most impacted

ANZ’s data showed the spending slowdown was nationwide, but, spending in Melbourne and Sydney took the largest hit.

Spending in Australia’s two largest cities is now near levels typical of lockdown conditions. In fact, total spending in Sydney has been at its lowest point since COVID began.

Melbourne was less impacted by the spending slowdown when compared with Sydney. Melbourne’s economy recovered faster after Delta lockdowns than Sydney’s, which was hit harder by interstate travel restrictions through 2021.

Spending has also fallen in the formally COVID free states of Queensland, South Australia, and Western Australia. ANZ’s data shows hospitality spending in Queensland and Western Australia is similar to previous lockdown conditions.

The service sector faces largest impact

The reported decline in spending is being fuelled by shoppers’ caution about being in public places and staff shortages that force businesses to close their doors in the dining, retail, and travel sectors.

ANZ’s senior economist Adelaide Timbrell said customer-facing businesses such as hospitality took the biggest financial hit.

She said, “Clothing retailers will also face some serious declines because we do tend to see that clothing goes down by around 70 per cent in lockdown conditions. And really anyone who relied on foot traffic, socialising, or community-based spending.

“Furniture and appliance retailers will also see a temporary decline because for those bigger, more expensive items, we do see that people are less likely to buy those online.”

Risk of another COVID recession

Consumer spending is a major driver of economic growth, so this slump in spending puts the economy in a precarious position. Should the slump drag on, Australia’s economy will be at risk of another COVID recession.

Ms Timbrell cautioned the economy was already taking a big hit.

She said, “The longer this malaise in spending goes on, the more risk it shows for the economy. Unlike a recession or downturn due to finance, it can bounce back really quickly.

“So as soon as this malaise ends, it will probably end very, very fast, but the longer it goes on, the more likely it is to cause economic damage. And if we don’t see government income support for people who are being affected, that will have more lingering effects.”

Treasurer Josh Frydenberg acknowledged in a statement that COVID remains a significant challenge for the economy.

He said, “The spread of Omicron is a reminder that we are not out of this pandemic and that significant challenges to the economy remain.

“The Morrison government has stood alongside businesses every step of the way as we continue to provide unprecedented support to keep their doors open and Australians in jobs, including the loss, carry back and immediate expensing measure, small business tax cuts and SME loan guarantee schemes.

“To secure Australia’s economic recovery, we must continue to open safely, learn to live with the virus, and stick to our economic plan of growing the economy.”

Read more:National cabinet gives a RATs: Changes announced in rapid antigen test rollout

Read more:Australian exporters continue to target world’s largest economy

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.