Keeping track of receipts for taxes doesn’t have to be a headache or require expensive apps. In fact, there are several simple (and low-cost) ways to organize your receipts without needing any fancy tools.

Whether you’re a small business owner, freelancer, or just someone trying to stay organized, there are easy ways to manage receipts without getting overwhelmed by technology or high costs. Here’s how to keep your tax game strong without the tech overload and still ensure that every deductible expense is accounted for when tax season comes around.

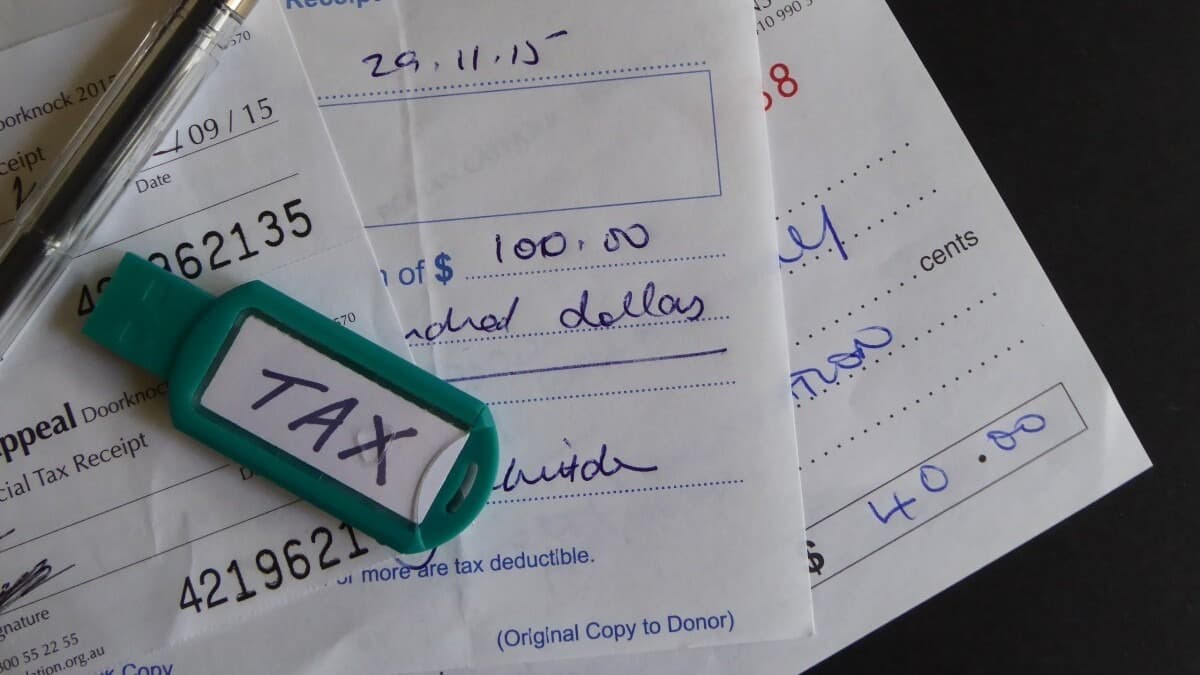

Create a physical filing system (Old school and effective)

Get back to basics with a simple filing system. Grab a folder, binder, or accordion file—whatever works best for you—and start categorizing your receipts by category: Meals, Travel, Office Supplies, etc. For bonus points, you can also organize by month or quarter.

This old-school method keeps things tangible and easy to grab when you need them. Plus, there’s nothing like flipping through neatly organized folders to give you a little sense of control.

Envelope system for simple organizing

If you’re looking for an even more straightforward approach, try using envelopes. One for meals, one for office expenses, one for travel—it’s as simple as that!

Add a date range on each envelope, and voila! When it’s time to do your taxes, just grab the right envelope and tally up your expenses. No fuss, no mess.

Spreadsheet tracking (Tech-free, but not totally manual)

For the spreadsheet lovers (we see you), Excel or Google Sheets can be a lifesaver. Set up columns for the date, merchant, amount, category, and a short note about what the purchase was for. The best part? You can filter or sort the data any way you like when tax season rolls around. It’s an easy way to track expenses without going overboard with apps.

Pen-and-paper logbook

If you’re a fan of pen and paper, consider keeping a logbook to record your receipts. Jot down the date, amount, vendor, and expense type. Whether you separate by business or personal or by month, you’ll always know where your receipts are—and they’ll be organized, too. Plus, there’s something satisfying about crossing off items in a ledger.

Set a regular sorting sched

The secret to staying organized is regular maintenance. Pick a day each week or month to go through your receipts, file them away, and enter them into your system. Whether you’re using a filing cabinet, spreadsheet, or envelopes, setting aside 15 minutes a week to keep things tidy means you’ll never be scrambling at tax time. Stay ahead of the chaos with a regular sorting habit.

Dedicated receipt wallet or folder

For the person who’s always on the move, keep a small wallet or folder in your bag or car. As soon as you make a purchase, toss the receipt in. Once a week (or whenever you’re at home), go through your receipts, organize them into your filing system, and you’re done! This easy method is perfect for anyone who doesn’t want to carry a ton of receipts around but still wants to stay on top of them.

Digital Tools (If you’re into apps)

Sometimes, you just want the tech to do the work for you. Lucky for you, there are plenty of tools to streamline the process. These apps can help you scan, categorize, and store receipts in a flash. Here are a few options to consider:

Expensify

How it works: Expensify lets you scan receipts, which it automatically categorizes for you. The app uses OCR (Optical Character Recognition) to extract key details like date, amount, and merchant, plus it can track mileage.

Why it’s good: It’s easy to use and integrates with accounting software like QuickBooks.

Cost: Free for basic use; paid plans start at $5/month.

Shoeboxed

How it works: Snap a photo of your receipts, and Shoeboxed does the rest, organizing them in the cloud. You can also track mileage and store documents.

Why it’s good: The receipt scanning is highly accurate, and it’s great for organizing business-related documents.

Cost: Free for up to 5 receipts/month; paid plans start at $15/month.

Wave

How it works: This free accounting tool also offers a receipt-scanning feature, so you can upload and track receipts for tax purposes. It even lets you link your bank accounts and generate financial reports.

Why it’s good: It’s an all-in-one tool for small businesses—and it’s free!

Cost: Free.

QuickBooks Self-Employed

How it works: If you already use QuickBooks, this app makes it easy to snap pictures of receipts and sync them with your account. It automatically categorizes your expenses, making tax reporting a breeze.

Why it’s good: Seamless integration with your existing QuickBooks account.

Cost: Starts at $15/month.

Receipt Bank (Now Dext)

How it works: Snap photos of your receipts, and the app extracts and categorizes the data. It also integrates with accounting software like QuickBooks and Xero.

Why it’s good: Accuracy and automation are the key selling points here.

Cost: Starts at $15/month.

Expensr

How it works: Expensr is a simple expense tracker app where you capture receipts and categorize them.

Why it’s good: Easy-to-use and perfect for anyone who just needs a basic tool for tracking receipts.

Cost: Free.

Bonus Tip: Use Your Smartphone’s Built-in Tools

Not into apps? No problem! Your phone’s camera and built-in storage (Google Photos, Apple Notes) can work just as well. Take a picture of each receipt, then store them in folders categorized by month or type of expense. It’s not as automated as the apps, but it’s free and gets the job done!

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.