Consumer credit growth is being quickly matched by the spike in popularity of buy-now-pay-later among Australian consumers, as inflation rises and the cost of living hits households but regulations may be limiting the trend.

According to the Australian Household Threshold Research Report, nearly eight out of ten Australian consumers utilise credit to pay unexpected costs.

Following credit cards in the first place, debit came in second at 30 per cent, and BNPL came in eighth at 8 per cent.

“BNPL solutions continue to grow in popularity, with people wanting to see solutions for larger, unexpected costs – especially among younger demographics whose financial worries are more elevated,” the report notes.

“This demand is probably due to the growing familiarity with BNPL solutions currently on the market from a range of providers, and a growing network of merchants offering BNPL.

“It seems clear that with over 70 per cent of younger generations wanting to use BNPL solutions to pay surprise bills, there is greater scope to expand these services beyond their traditional retail reach.”

According to the Reserve Bank of Australia, the value of BNPL transactions increased by 55 per cent in 2019-20 to more than A$9 billion, and this trend was maintained during the pandemic as internet shopping surged. (Full report here)

In Australia, heavyweights in the BNPL sector include AfterPay, Zip, Brighte, flexigroup, Openpay, and Payright., among others. Moreover, as per reports, the extremely competitive buy now, pay later industry has a new entrant, with National Australia Bank attempting to entice customers away from the likes of Afterpay and Zip Co,.

NAB clients can pre-register for early access to the new “NAB Now Pay Later” service, which, like comparable services, allows users to take their purchases home instantly while spreading payments out over several weeks.

Yes, but

Last year, the Reserve Bank of Australia (RBA) reversed its stance on the buy now, pay later (BNPL) sector and allowed retailers to pass on BNPL costs to customers under new regulations.

This decision represents a shift in the RBA’s position, which previously supported BNPL platforms in upholding the no-surcharge rule that retailers are required to follow. The rules currently limit merchants’ ability to pass on the costs of providing these BNPL services to customers.

Despite their rapid growth, “BNPL operators in Australia have not yet reached the point where it is clear that the costs arising from the no-surcharge rule outweigh the potential benefits in terms of innovation,” according to RBA governor Philip Lowe in December 2020.

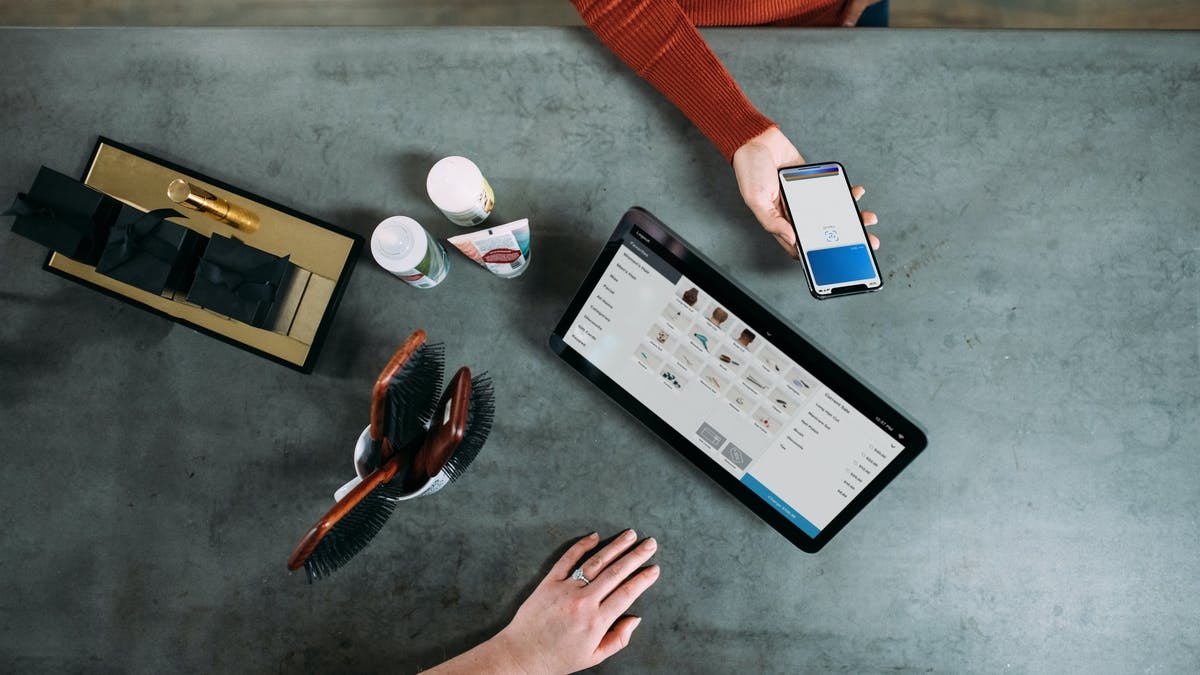

Small businesses all over Australia have used BNPL options to attract new customers and increase the purchasing power of existing customers. BNPL services were bound to attract regulatory scrutiny as they grew in popularity and became an expected payment option among younger shoppers.

Where and how are Aussies using BNPL?

Data show a diverse range of instalment payment demands. With the cost of dentistry rising, 29 per cent of 1,000 Australians polled said it was the top service they’d like to pay for through BNPL.

Car repair was a close second, with 29 per cent (rounded up) of respondents seeing BNPL as a way to spread these costs out over time. The generic catch-all category of home improvements was third, with a 25percent of participants naming it as another category ripe for BNPL use.

Surprisingly, the Northern Territory and the ACT had a higher proportion of residents (42 per cent) who would use BNPL services for auto repairs. More than half (52 per cent) of South Australians are unlikely to use BNPL in general.

Inflation woes hurting households

Antenna Strategic Insights conducted the survey on behalf of QuickFee and discovered that an unexpected bill of more than $1,500 would stretch the budget of 45 per cent of households.

Furthermore, an additional $500 would put pressure on approximately a 60percent of households – nearly two-thirds – who would struggle to pay a surprise bill of more than $2,000.

Meanwhile, 15percent of Australians would be unable to pay a $1,000 unexpected charge, and half would pay an unexpected cost with a credit card, but they are eager to use But Now Pay Later for more than just the latest high street trends.

The data is contained in the new Australian Household Threshold report – https://quickfee.com.au/the-australian-household-threshold-report/

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.