In today’s environment, many customers have been struggling to find ways to enjoy Australia’s fantastic culinary offerings while still managing their cash flow. Turns out, there’s an alternative payment option to accomplish this in more than 700 bars, restaurants, and cafes across the country.

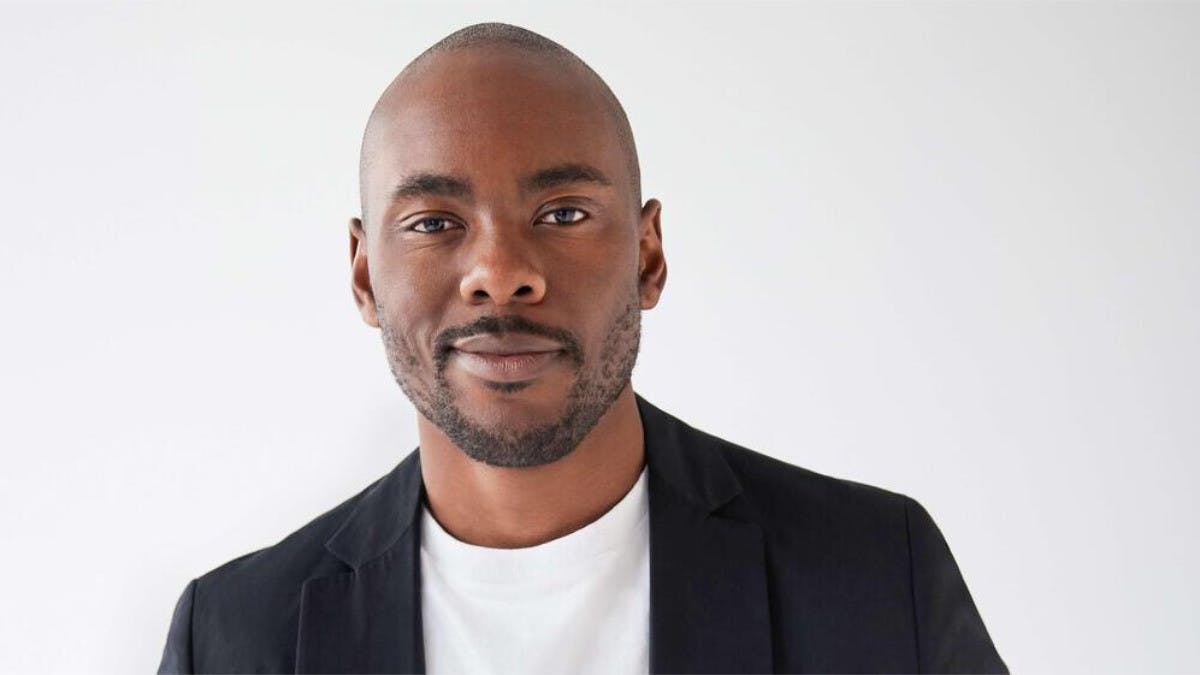

“For me, starting payo became an aspiration when I saw an opportunity to introduce new technologies into the hospitality industry, particularly around payments,” said Taf Chiwanza, co-founder and CEO of payo.

“There was so much development and opportunity my co-founders Sean Donnelly, Scott Lai, and I were seeing from other industries, so we thought why not bring these to hospitality?”

In what’s been dubbed the ‘AfterPay of the hospitality industry’, payo allows customers to pay the bill in four fourtnightly installments with zero interest. They can check themselves out using the unique payo checkout QR code on the table, split the bill, and leave a tip, all on the app.

This allows restaurants to save an average of 10 minutes per table (therefore turning over tables quicker) and also saves around 15 per cent per order for customers, thanks to discounts and and incentives, according to Taf.

Since launching in March 2021 in Brisbane, payo has partnered with over 750 locations across additional cities like the Gold Coast, Melbourne, and Sydney.

From sports management to hospitality tech

Originally from Zimbabwe, Taf first moved to Australia to study sports management and international business at Griffith University with the hopes of becoming a sports agent for soccer players or golfers. After some time in sports management, he decided to pivot to sales.

“This move landed me in a workforce management software startup (specialising in venue and restaurant rostering) and then a marketing platform, both of which serviced the hospitality industry. This is where my passion for technology and hospitality converged,” he added.

Taf then relocated to Melbourne to lead the Australian operations of Zomato as Country Manager. That is, till the pandemic hit and the company exited Australia.

It became the perfect opportunity to channel his passion for tech and hospitality into a new app that would evolve Australia’s dining game.

“I enjoy the impact you can have when you’re building something. Entrepreneurship is a great outlet for finding solutions for decade old problems with likeminded people,” said Taf, who counts American billionaire investor and hedge fund manager Ray Dalio, and Spotify co-founder Daniel Ek, among some of his role models.

“The initial idea for payo came from conversations between [co-founder Sean Donnelly] and myself that snowballed once the pandemic hit. We both worked in hospitality and could see the great advancements tech and payment flexibility was having in other industries.”

It eventually led to offerings like their first-to-market payments technology designed especially for hospitality to allow checkout from the table at any point during a meal. According to Taf, their solution helps to reduce friction and preserve staff-patron service interactions, reduce waiting times spent to pay the bill, and reduce chances of turning groups aways because a venue won’t split the bill.

Addressing buy now, pay later scepticism

Buy now pay later (BNPL) products, which allow customers to buy goods or services instantly and pay for it in instalments, have seen their fair share of criticism in the last few years. Much of this surrounds regulation and the need for further scrunity. For some consumer groups, there are concerns it could exacerbate financial harm for people already struggling to make repayments, and affect credit scores, especially for younger consumers.

“Payo is more than just a standard BNPL solution and we’re focused on a lot more than just credit lending,” Taf explained. “We are designed for the hospitality industry so we’ve developed a sustainable business model that serves customers and restaurants rather than profiting from them. The bar has been set high for Eat Now, Pay Later through our credit checks and early restrictions to cap users’ debt if they incur miss-payments.”

He also welcomes regular, mandated reporting for the broader BNPL industry “so that the economic cycle and consumer habits are better understood.”

Taf notes that feedback for payo has been fantastic so far, with their journey teaching them a lot about how customers and venues interact, and where the pain points lie in this industry.

READ MORE: Founder Friday with Jacqui Bull: transforming Australia’s staffing market

“We’ve learnt that the two clear demands from dining customers are speed and convenience when it comes to payments. Having recognised this, we started to look more holistically at the challenge to flesh out the concepts that would become the basis of the payo checkout product,” Taf added.

“We released the self-checkout technology with half the features we thought were needed. But along the way, we’ve since found that some of those original concept feature ideas did not directly address restaurants’ needs effectively, so we re-evaluated where we could drive value and impact. Data and restaurant feedback have provided far more insights into the self-checkout experience which has made space for other features to emerge, such as split billing.”

Modernising the hospitality industry

With more than a decade of experience in hospitality tech, Taf has been able to witness first-hand the ongoing shift in the industry, especially in the last few years with lockdowns, supply chain troubles and staffing shortages impacting the basic operations of a hospitality business.

“There’s no ‘one-size-fits-all’ solution for success in hospitality, but there are clear trends that have contributed to the businesses that were able to persevere through the hardships,” he observed. “Technology has noticeably modernised the industry with innovations touching on rostering, stock ordering, talent hiring, payments, table ordering accounting and point of sale systems. By alleviating the admin burden, reducing cumbersome processes, and implementing automation, the strain on restaurant owners, staff and diners is dramatically eased.”

Modernising the industry continues to inspire the work at payo, he adds.

“The long-term goal is to continue to build a payments ecosystem that makes better experiences for diners and eases the frustrations of hospitality. We have a shared mission to use technology to enhance dining out to become the absolute best experience possible in a restaurant but we’re just as focused on helping restaurants make more money.”

And what are some of the key lessons from his business journey so far?

“Avoid regrets by taking risks. Also, stop focusing on the negatives or the mistakes made. Do what works and repeat it until customers stop buying it.”

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.