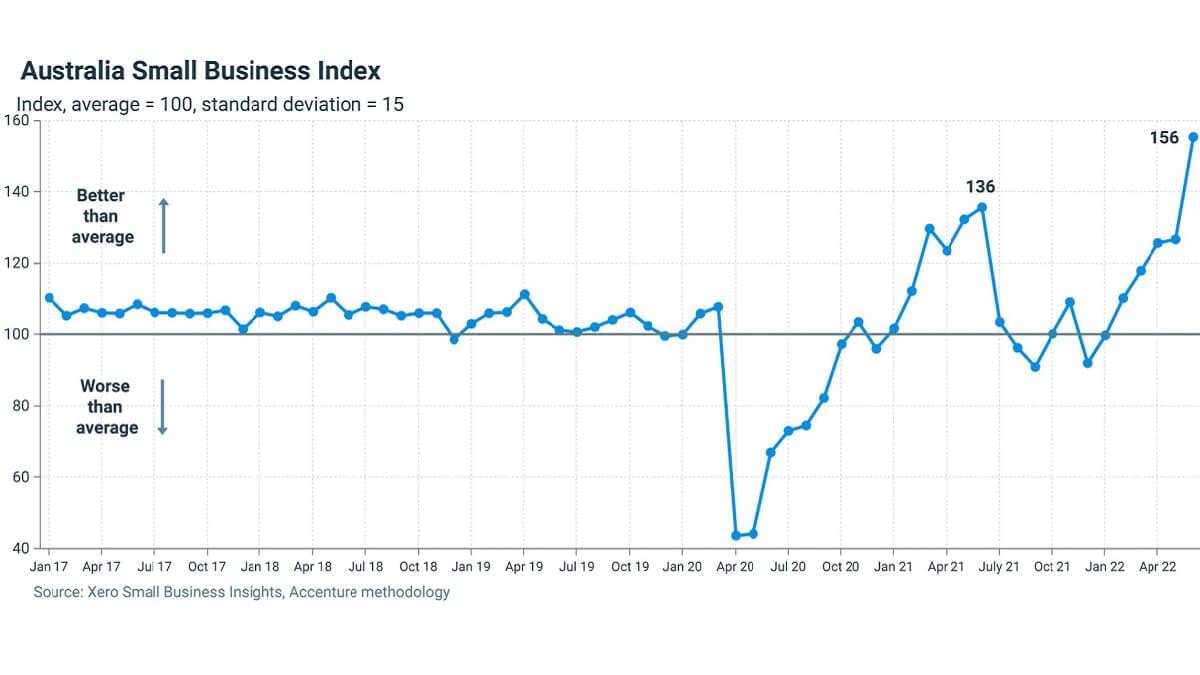

The Small Business Index for Australia from Xero increased by 29 points to 156 points, which is the best score ever obtained.

The average amount small businesses had to wait before being paid decreased by 3.5 days to 20.1 days, which is mainly responsible for the increase.

In February 2022, the Index increased by three points to 102.

The sharp drop in payment times is likely due to the conclusion of the fiscal year, and it mirrors a similar change seen in New Zealand and the United Kingdom in March. In terms of the other indicators, wages and sales slowed, while jobs delivered the best result since November 2021.

In June, the average time it took for small businesses to be paid was reduced by 3.5 days to 20.1 days. Late payments were also reduced by 2.2 to 4.7 days, a record low for this series, which began in January 2017.

While these gains are significant, they are most likely attributable to the end of the fiscal year and may be revised in the coming months. For example, the first report for June 2021 predicted a 2.9-day reduction to 20.1 days, but this estimate has since been changed to 22.4 days.

Sales are holding up better in Australia

Despite buyers experiencing higher cost-of-living pressures, sales have maintained steady, increasing a solid 10.6 per cent yearly (y/y). All industries experienced strong revenue growth, with administrative services leading the way at +15.9 per cent annually.

When prices are included, sales volume increases by 4.5 per cent yearly using the June quarter Consumer Price Index. However, data demonstrate that small firms sold more goods and services in June 2022 than in the same month in 2021.

This is a far better outcome than small businesses in the United Kingdom and New Zealand, where sales actually fell in the year to June once the impact of price increases was eliminated.

“The sales results show that Australian small businesses continue to sell more goods and services than they did a year ago, despite customers facing the cost of living pressures,” said Louise Southall, Economist, Xero. “It’s a testament to how our small business economy has shown resilience through the current inflation crisis.”

A strong month for jobs

Jobs increased 2.0 per cent year on year in June, following a 0.2 per cent year-on-year increase in May.

Administrative services (+6.9 per cent year on year) and professional services (+4.4 per cent year on year) led to these results, repeating prior months when industries that allow for work from home were better able to add jobs.

Continuing recent patterns, education and training (-1.9 per cent year on year), wholesale trade (-0.5 per cent year on year), and agriculture (-0.2 per cent year on year) were the three industries still experiencing job losses.

Wages rose 3.3 per cent y/y in February 2022 and are little changed from the 3.4 per cent growth recorded in January.

“The jobs result is hugely positive, and fantastic to see a rebuilding in recent months after a soft start to 2022,” said Southall.

To download the complete June results, including industry and regional breakdowns, go to the Xero website here.

To find out more about how the Xero Small Business Index is constructed, see the background information and methodology.

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.