MYOB launches AI-powered mobile app to help small business owners escape admin hell and focus on growth

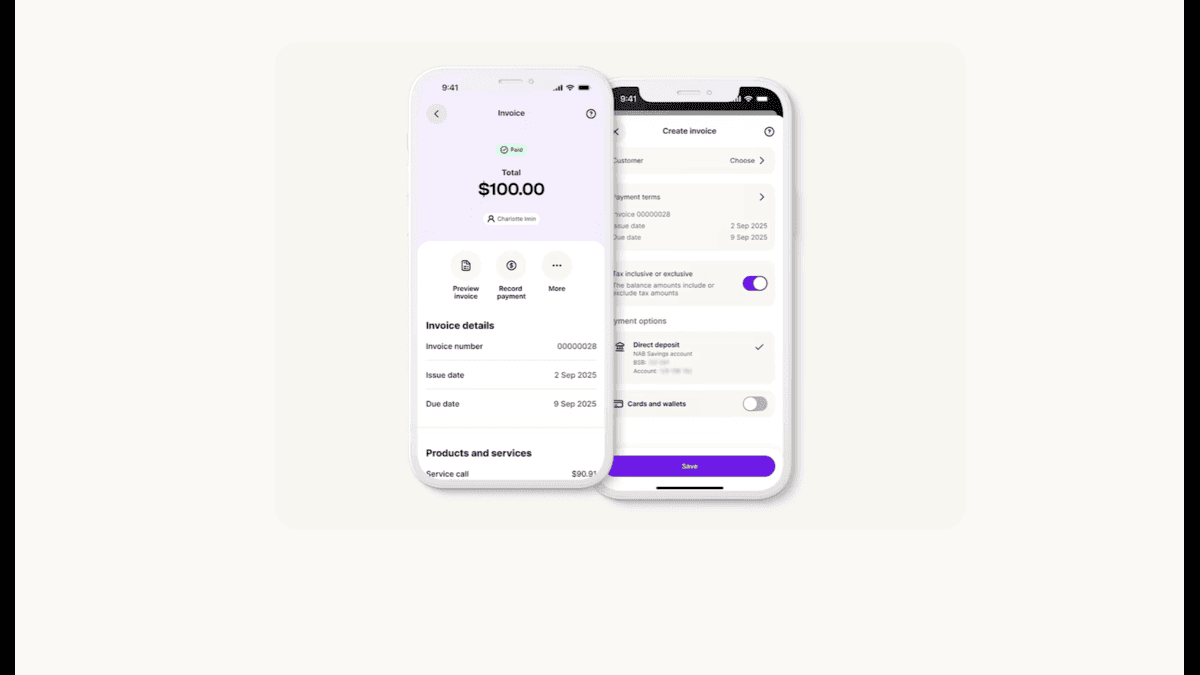

What’s happening: MYOB has launched MYOB Assist, an AI-supported mobile app designed to streamline admin tasks for small business owners. The app features smart receipt capture, real-time invoicing, and automated categorisation, all syncing seamlessly with MYOB’s browser-based accounting systems.

Why this matters: With research showing 56% of SME owners spend more than half their time on internal operations, and 17% citing tax compliance as their biggest profitability challenge, mobile admin solutions could free up significant time for business growth and customer focus.

Small business owners juggling receipts, invoices, and payments while running their operations have a new ally in the fight against administrative chaos. MYOB this week launched MYOB Assist, an AI-powered mobile app designed to transform time-consuming admin tasks into simple, effortless processes.

Built into every MYOB Business and AccountRight subscription, the new mobile app leverages browser-based AI smart matching and categorisation to help business owners manage their finances on the go. The timing addresses a critical pain point: recent MYOB research reveals 56% of SME owners spend more than half their time on managing internal business operations.

“Small business owners are often on the move, meaning a constant juggling act when it comes to managing receipts, invoices and payments,” said Dean Chadwick, MYOB’s Chief Customer Officer. “MYOB Assist puts powerful, easy-to-use expense capture and invoicing tools in their pocket, helping them feel in control and freeing them up to focus on their customers, not their paperwork.”

Mobile-first solution

The app’s core features centre around ‘snap and track’ receipt capture and real-time invoicing, designed to ensure business owners never miss capturing a dollar. In-app data feeds directly into MYOB’s smart reconciliation features, working alongside AI-enabled browser-based automation to enable seamless cashflow management.

Key capabilities include on-the-spot expense categorisation, instant transaction matching, and smart receipt syncing, all running seamlessly in the background while business owners focus on their customers. The app syncs with MYOB’s browser-based systems, allowing users to bill on the fly and capture expenses immediately.

This mobile-first approach addresses the reality of modern small business operations, where owners are frequently away from their desks but need to maintain tight control over their finances. By making admin mobile and manageable, MYOB aims to help customers stay on top of their paperwork and feel well-prepared for tax time.

Real customer impact

Early adopter Adrian Katz of Katz Studios demonstrates the practical benefits of the new system. The video production and animation specialist says the app has simplified his invoicing and expense capturing processes, delivering measurable time savings.

“As soon as I finish a job, I can send an invoice on the spot – no delays, no extra admin,” Katz explained. “The interface is simple, clean and seamless to use, and having an all-in-one expense and invoicing app that I can use on-the-go has really saved me time.”

For Katz, the efficiency gains translate directly into business focus. “Now I can focus my efforts on the core drivers of my business – editing, video production and animation – instead of paperwork,” he said.

Tax time relief

The app launch comes at a strategic time, with MYOB’s latest Business Monitor data highlighting that time spent meeting tax compliance obligations represents the biggest challenge to profitability for one in five SME respondents (17%). By digitising and automating administrative processes throughout the year, business owners can build confidence in their tax readiness.

“Through smart technology that works quietly in the background, the app can reduce admin stress and help small businesses feel confident, in control, and ready to grow,” Chadwick added.

MYOB Assist will transition existing users of MYOB’s Capture and Invoice apps to a unified experience designed for greater efficiency. The company plans to roll out additional features over time, each focused on optimising cashflow and streamlining admin for SMEs and their trusted advisors.

The app represents part of a broader trend toward mobile-first business solutions, recognising that small business owners increasingly need tools that work where they work – whether that’s on-site with clients, travelling between appointments, or managing operations from multiple locations.

With small businesses forming the backbone of the Australian economy, tools that can meaningfully reduce administrative burden while improving financial control could have significant implications for productivity and growth across the SME sector.

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.