In a stark sign of economic hardship, the average value of invoices held by Australian businesses has nosedived by 49.9% compared to June 2023. This drastic decline is a direct consequence of collapsing consumer demand, forcing businesses to slash inventory levels.

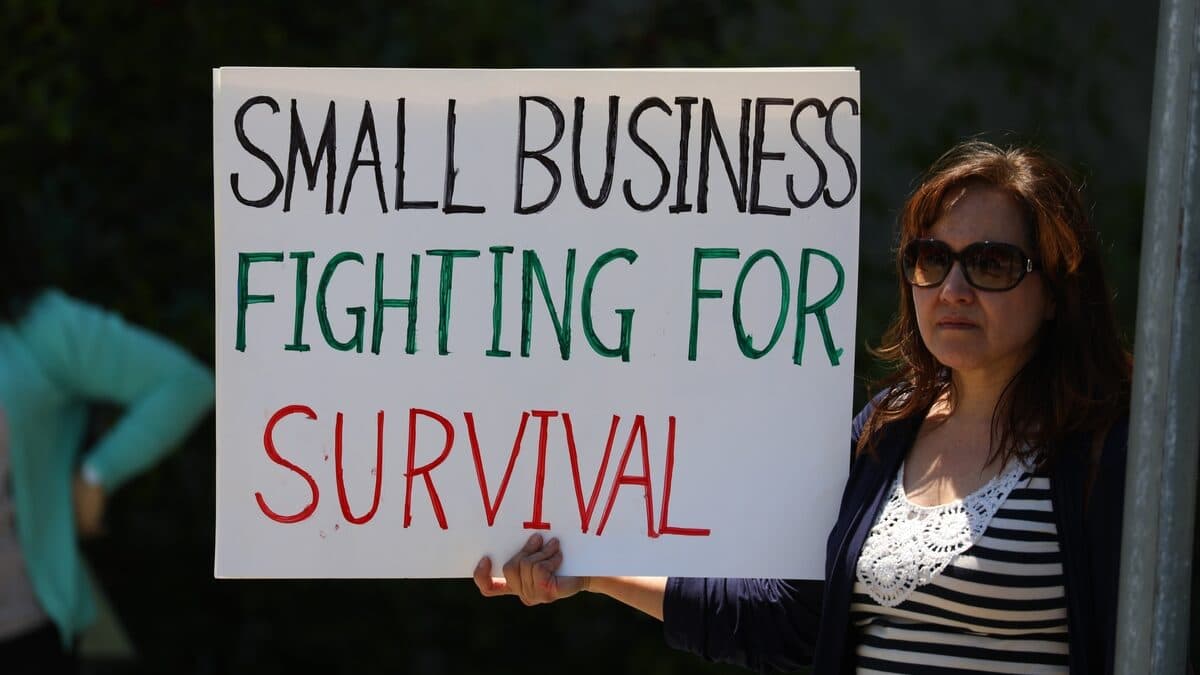

CreditorWatch has released the June results for its Business Risk Index (BRI), revealing a significant decline in the value of invoices held by Australian businesses. This downturn, driven by falling consumer demand, is forcing businesses to reduce inventory levels. CreditorWatch has revised its 12-month forecast for hospitality industry failures to 9.1%, meaning one in 11 businesses may face closure as economic conditions continue to worsen.

Business Orders Hit Record Low

The average value of invoices held by businesses has dropped by 49.9% year-over-year as of June 2024. This decline is attributed to businesses scaling back on inventory due to rising prices and decreasing demand. Additionally, invoice payment defaults have been on the rise since mid-2021, indicating increasing difficulties for businesses in meeting supplier payments despite lower order values.

Another critical metric from CreditorWatch shows an 8.8% increase in the business failure rate across all industries over the past 12 months.

Hospitality Sector Faces Higher Risk

The forecast for the hospitality industry has deteriorated, with CreditorWatch predicting the business failure rate to rise from 7.5% to 9.1%. This rate is significantly higher compared to other sectors, such as Arts and Recreation Services and Transport, Postal and Warehousing, which have forecast failure rates of 5.7% and 5.5%, respectively. The average forecast for all industries stands at 5.1%.

The hospitality sector is particularly vulnerable due to its reliance on discretionary spending, which has sharply declined as consumers deal with increased costs for essentials such as mortgages, rent, and utilities.

Rising Payment Defaults

While there was a slight dip in business payment invoice defaults from May to June, the trend has been upward since mid-2021, remaining well above pre-COVID levels. This rise in defaults, coupled with falling demand, has squeezed businesses, making it more challenging to pay suppliers. CreditorWatch has identified a strong correlation between B2B payment defaults and the likelihood of subsequent business failures.

Other Key Insights from CreditorWatch’s June Report:

- Court Actions: There has been a 37% increase in court actions over the year to June 2024, now exceeding pre-COVID levels.

- Credit Enquiries: These dropped from May to June and have remained flat throughout 2024, indicating subdued trading conditions.

- ATO Tax Debts: The Food and Beverage Services industry has the highest rate of outstanding ATO tax debts over $100,000 at 1.65%, followed by Construction (1.18%) and Electricity, Gas, Water and Waste Services (0.94%).

- Best Performing Regions: Adelaide leads as the best-performing capital city CBD, followed by Perth, Melbourne, Brisbane, and Sydney. Regions with the lowest risk of business failure are in regional Victoria, inner-Adelaide, and North Queensland, with Norwood-Payneham-St Peters (SA) ranking highest.

- Worst Performing Regions: Areas in Western Sydney and South-East Queensland, with Bringelly-Green Valley (NSW) having the highest risk of business failure at 7.63%.

Economic Outlook

CreditorWatch CEO Patrick Coghlan expressed deep concern about the current conditions for Australian businesses, stating that the combination of declining order values and increasing payment defaults is alarming. He anticipates further deterioration with potential interest rate hikes.

Chief Economist Anneke Thompson highlighted the challenging phase of the monetary policy cycle, noting that high debt costs are exacerbating inflation issues. She emphasized the lag in monetary policy decisions, which means businesses must endure high interest rates even as consumer demand weakens.

The June 2024 data from CreditorWatch underscores severe economic pressures on Australian small businesses, particularly in the hospitality sector. With monetary policy settings and rising prices impacting consumer confidence and demand, the trend is expected to persist into 2025. This scenario is likely to result in higher business failure rates and a potential rise in unemployment, further straining the economic landscape.

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.