Artificially inflated donation deductions are attracting ATO attention. Finance expert warns short-term tax gains could become long-term liabilities for unsuspecting SMEs.

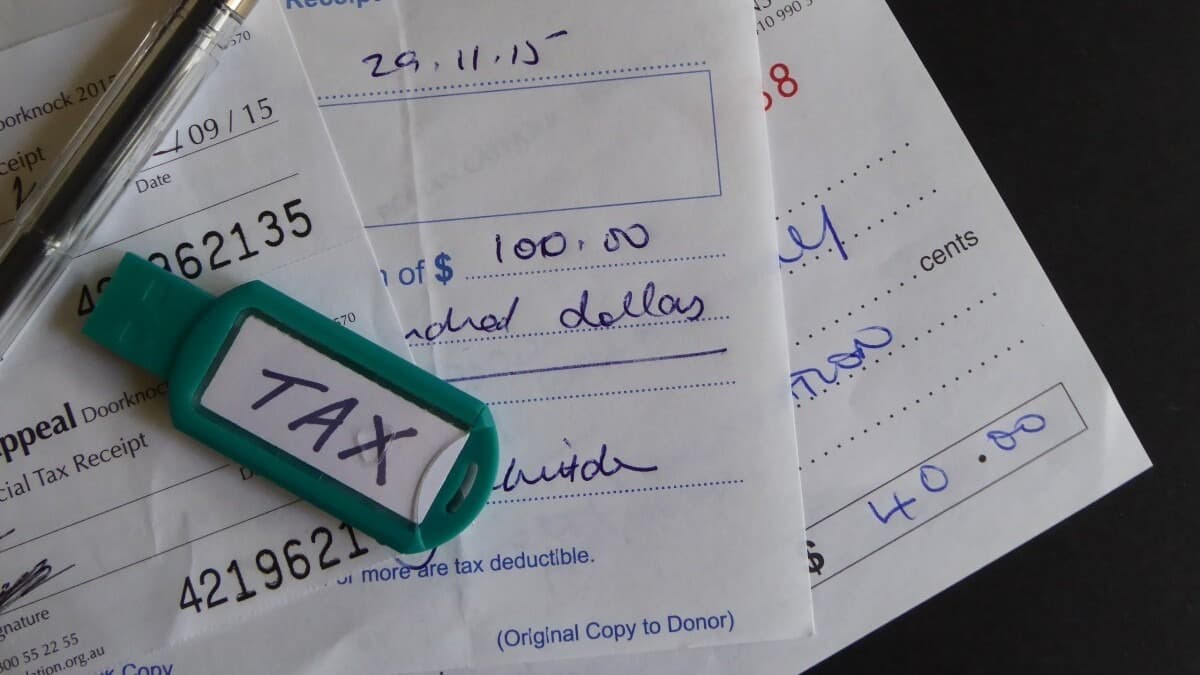

What’s happening: The Australian Taxation Office is warning business owners to avoid an emerging tax scheme involving barter credits, where people artificially inflate deductions for donations to charities.

Why this matters: For cash-strapped SMEs tempted to save money through barter networks, this scheme carries risks that go way beyond tax penalties. Businesses unknowingly involved could suffer damaged reputations if they’re linked to fraud targeting charities.

Australian small businesses struggling with tight cash flow are being warned about a tax scheme that promises big deductions but could deliver criminal investigations instead.

The scheme lets people access barter credits with a face value much bigger than what they actually paid to barter exchanges. Someone might pay a small cash amount to get barter credits worth way more, then donate these credits to a charity and claim a larger tax deduction than they deserve.

How it works

The setup looks straightforward but it’s potentially fraud. Barter exchanges let participants buy credits at inflated values, which they then donate to charities. The tax deduction they claim is far more than what they actually spent.

“While it’s not unlawful for DGRs to accept barter credits as donations, participating in arrangements where deductions for barter credits are artificially inflated could be fraud and may result in an investigation by the ATO,” ATO Deputy Commissioner Erin Dale said.

This scheme is popping up just as SMEs are under pressure to keep cash flowing through tough economic times. But the temporary relief from inflated deductions comes with serious strings attached.

The real cost

Businesses caught up in this may have to pay back the tax, plus cop heavy penalties, interest, and possible legal action. Under promoter penalty laws, the ATO can slam heavy civil penalties on anyone promoting dodgy tax schemes.

The warning applies even when schemes are pushed by financial advisers or tax agents. Dale stressed that if something sounds too good to be true, it probably is, and business owners need to be careful when looking at any deal promising major tax cuts or avoidance.

For SMEs already juggling complex tax compliance rules, the scheme is a dangerous shortcut. Those who come forward to the ATO on their own might get reduced penalties.

Your reputation matters

Beyond taking money from the community, the scheme is undermining public trust in charities with tax deductible status. The charities receiving these donations might not even know they’re caught up in a tax scheme.

For small businesses, reputation damage from being linked to fraud targeting charities could cost more than the financial penalties. Customer perception can change fast when businesses are connected to schemes exploiting charitable organisations.

This risk hits hard as compliance becomes part of protecting your brand. Businesses that stick to legitimate tax strategies over questionable schemes protect both their money and their market reputation.

What to do

Business owners who’ve been offered a scheme they think is dodgy should reject it and report it to the ATO. Reports can be made confidentially by calling 1800 060 062 or filling out a tip-off form.

For those already involved, act fast. “If you think you’re involved in an unlawful tax scheme, we can help you. If you proactively approach us, you may be eligible for a reduction in penalties,” Dale said.

The ATO lists examples of dodgy tax schemes on its website, giving business owners the tools to spot problematic deals before jumping in.

As money pressures keep building, the temptation to chase aggressive tax strategies won’t go away. But the line between legitimate deductions and fraud is clear, and crossing it brings consequences that reach far beyond the tax office.

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.