Finance leaders from mid-sized businesses (100 to 999 employees) are known for keeping a watchful eye on nuanced signals and indicators of potential risk. And yet recent results from a survey conducted by Oxford Economics and SAP of small and mid-sized businesses found that roughly half of finance executives from mid-sized businesses cite risk management (54 per cent) and spend visibility (45 per cent) as top challenges for their function.

In many ways, COVID-19 presented a perfect storm of cash-flow issues in a matter of days. Economic contraction fuelled by government pressure closed non-essential stores and offices. Revenue was lost due to interrupted manufacturing operations and overwhelmed supply chains. Credit risk exposure rose as liquidity constraints emerged, once-successful hedging strategies failed, access to working capital tightened, and customer accounts became riskier.

Throughout this time, demand for SAP Ariba Discovery, a solution that was made available at no cost through the end of 2020 to help connect buyers and suppliers and keep supply chains intact, grew significantly in Australia – with buyer postings up +317 per cent and supplier responses up +339 per cent since the lockdown started in March. This demand highlighted the appetite for digital tools for businesses of all sizes to help them manage the effects of the crisis.

But just as the Australian economy was slowly starting to regain momentum, the Victorian Government has introduced stage 4 restrictions following a second wave of infections. The Treasury has estimated this six-week lockdown will cost the national economy about $9 billion. The ongoing sense of uncertainty highlights the importance of increasing resiliency with cash-flow management and digital tools, with three steps that mid-sized businesses should take to secure cash flow.

1. Ensure continuity of finance operations and workforce

Financial systems should be able to support mission-critical activities – such as urgent supplier payments, cash transfers, and trade management – whether the employees are processing them in the office or from a remote location.

When facing disruption, businesses need to make sure they have the finances on hand to keep business moving. Organisations need to ensure business continuity and reduce supply chain risk while still controlling costs and working capital. Moreover, suppliers need access to cash so they can keep delivering the goods and services required.

SAP Ariba has been putting the power back into the hands of suppliers by affording them choice and flexibility when it comes to payment terms. This is especially important at a time when effective cash management has never been more crucial to both buyers and suppliers. This not only safeguards the supply chain, but also allows businesses to build crucial relationships and resources to enhance financial results over the long term.

2. Manage finances proactively

As organisations reforecast revenue and profitability, continued cost and cash control will be critical to rebuilding the bottom line. But as customers begin buying again, businesses must balance the need to free up working capital with sourcing the materials and talent needed to meet customer demand.

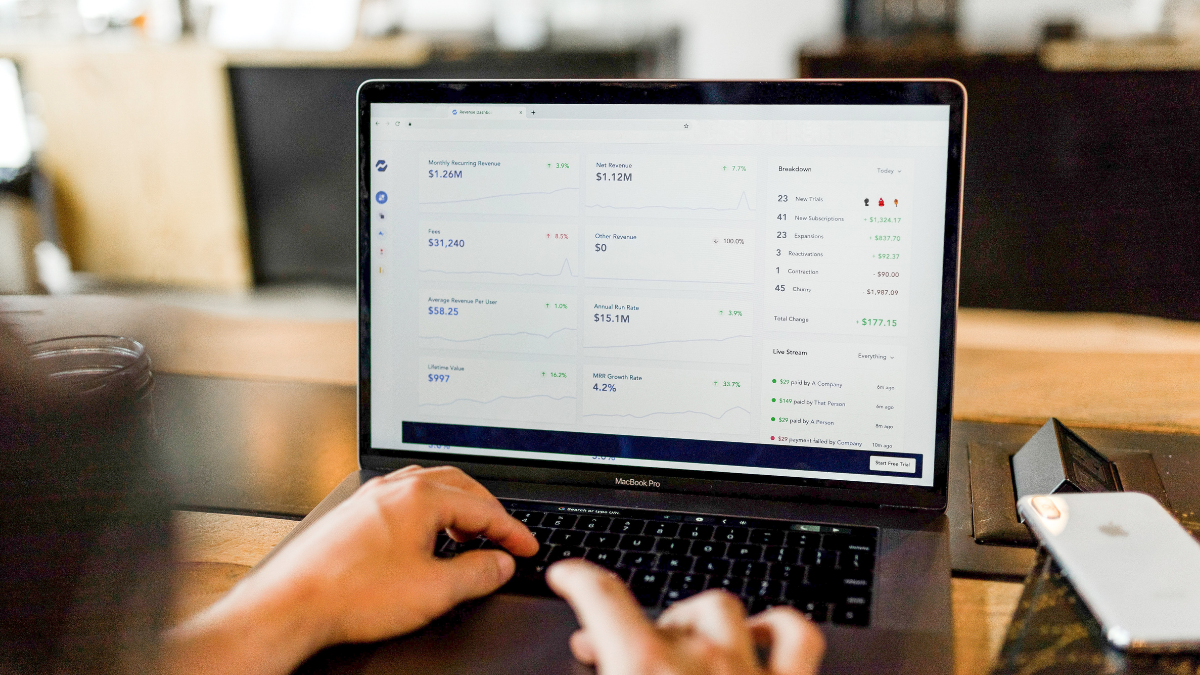

Through times of volatility or steady growth, knowing the company’s financial status is critical. This is why, in the past few months, SAP customers have been using our technology to run daily cash forecasts. Daily reports on key figures – including the daily cash position, cash-flow forecasting, the structure of free cash flow, working capital and debt – enables finance teams to do liquidity planning for at least 12 weeks.

If this kind of reporting is not already in place, financial leaders need to implement tools that provide a combination of visibility and predictive analytics. Blending data insight with guidance gives finance leaders a clear view of the business and helps future planning.

3. Balance risk with opportunity

Analysing a range of scenarios enables finance leaders to evaluate the potential impact of risks and implement strategies to enhance competitive advantage. It also means they can finetune product and capacity plans by rethinking the implications of commodity risk and monitoring external markets.

Tapping into insights from cash-flow planning analysis, finance teams can adjust their hedging strategies by:

- Addressing foreign exchange risks

- Shifting limit management practices for ad hoc tasks

- Mitigating credit risk within the supply chain

- Reshaping the funding strategy with extended credit lines and new sources of liquidity

- Adjusting the ongoing operating model and updating the existing business continuity plan

4. Respond to the challenge and get ready for what’s next

Whether running in good financial shape, struggling for profitability, or facing low cash reserves, all mid-sized businesses can become vulnerable to cash-flow instability. It doesn’t require a global pandemic to experience it.

In the short term, state and federal governments are supporting businesses with emergency loans and payments. But as these forms of business life-support are withdrawn in coming months, organisations will need to find new ways to manage risk, increase resiliency and maintain profitability.

So, how do high-performing finance leaders help their business navigate through times of volatility and financial opportunity? It all comes down to a foundation of timely, meaningful and predictive insight with guidance on the potential implications for financial status, performance and viability.

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.